- Bitcoin open interest recently declined from $23 billion to $20.7 billion.

- Despite the drop in open interest, BTC’s price remains above $68,000.

The Bitcoin [BTC] open interest and price action are seeing notable shifts as market volatility increases ahead of the U.S. election week. Data indicates a sharp drop in BTC’s open interest on all exchanges, suggesting that traders are becoming more cautious amidst uncertain market conditions.

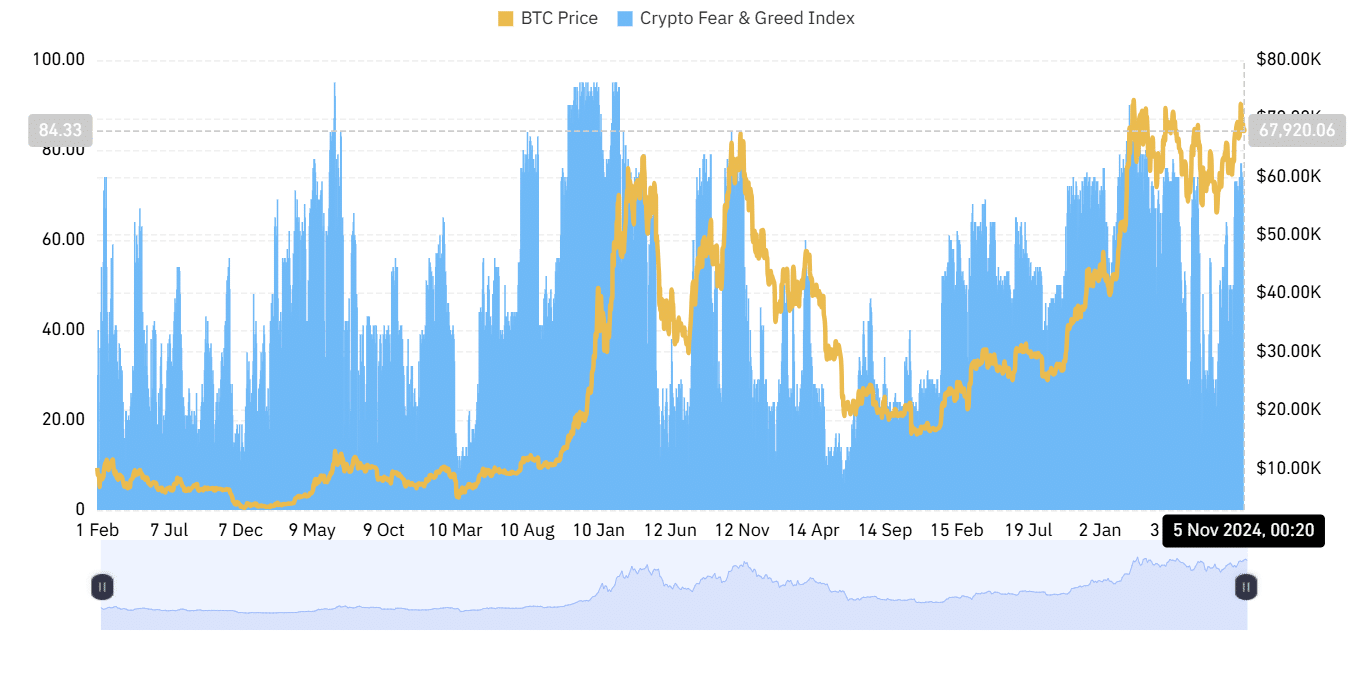

The current landscape reflects a cautious yet speculative environment, coupled with rising volatility in the S&P 500 (tracked by the VIX index) and the high readings on the Crypto Fear & Greed Index.

Bitcoin open interest decline: A sign of caution or an opportunity?

Bitcoin open interest has recently dipped from over $23 billion to $20.7 billion, reflecting a shift as traders unwind leveraged positions.

Historically, reduced open interest indicates less market leverage, hinting that traders may be pulling back from riskier bets. This trend could be influenced by the approaching U.S. election, as political events often bring added uncertainty and volatility to financial markets.

Source: CryptoQuant

Interestingly, despite the drop in open interest, Bitcoin’s price has remained steady above $68,000, suggesting underlying strength. This resilience may indicate that while leveraged positions have decreased, spot buying remains strong, potentially driven by long-term holders.

For traders, the reduction in open interest could signal a pause in speculative activity, but for long-term investors, it reinforces confidence in Bitcoin’s upward potential.

U.S. election’s impact on Bitcoin Open interest and market volatility

The VIX, or Volatility Index, for the S&P 500 has risen to about 21.97, signaling heightened fear in traditional markets. Historically, high VIX levels align with increased caution in riskier assets like cryptocurrencies.

Investors appear to be preparing for broader market fluctuations as the U.S. election approaches, influencing both equities and digital assets like Bitcoin.

Source: TradingView

The Relative Volatility Index (RVI) for Bitcoin, currently around 47.7, indicates potential price swings without a strong directional trend.

With the RVI close to 50, Bitcoin could experience further fluctuations, aligning with the cautious sentiment as the election nears. A regulatory shift following the election, particularly regarding digital assets, could add to Bitcoin’s volatility.

Bitcoin Open interest and sentiment indicators: Optimism amid caution

Despite the increased caution, the Crypto Fear & Greed Index sits at 70 (Greed), indicating that while caution exists, overall sentiment remains positive. This gap between high sentiment and cautious trading behavior suggests the market may be waiting for more certainty following the election.

Historically, Bitcoin has shown consolidation patterns or slight pullbacks before resuming trends in response to election outcomes.

Source: Coinglass

The combination of high sentiment and declining Bitcoin Open interest could imply that traders are hesitant to increase leverage yet anticipate BTC’s price resilience.

This pattern of elevated sentiment with lower leverage often leads to a consolidation phase, where optimistic investors wait for volatility to settle before fully re-entering the market.

Outlook for Bitcoin’s price and Open interest post-election

With the U.S. election as a potential catalyst, Bitcoin’s futures movements may depend on both political and macroeconomic developments.

Traders will likely watch for a breakout above $70,000 or a stable consolidation above key support levels to confirm a post-election upward trend. Conversely, any unexpected election outcome or new regulatory policies could temporarily disrupt Bitcoin’s path.

Read Bitcoin (BTC) Price Prediction 2024-25

As the election approaches, Bitcoin appears poised in a holding pattern, supported by long-term confidence yet tempered by short-term caution.

Metrics such as Bitcoin Open interest and the Fear & Greed Index will be crucial for gauging market sentiment. Depending on the election’s outcome, Bitcoin could either consolidate or set its sights on new highs in the months ahead.