- QNT nears a potential breakout with key resistance at $80.38, bolstered by bullish sentiment.

- Mixed on-chain signals hint at cautious optimism, with large transactions showing bullish interest.

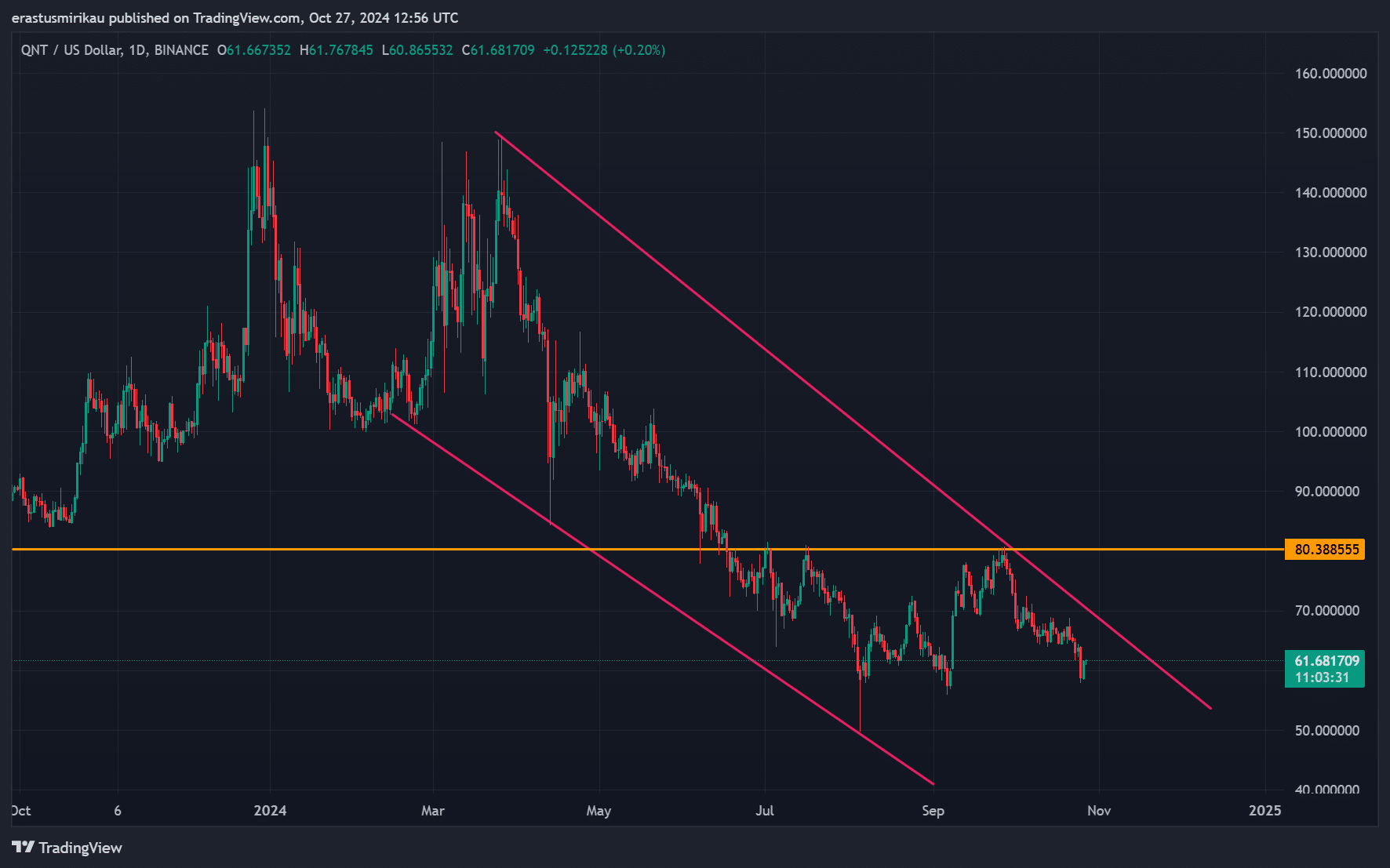

Quant [QNT] is on the brink of a crucial breakout, trading within a falling wedge pattern that hints at a possible bullish reversal. This prolonged downtrend appears poised to end, setting the stage for a potential price rally.

Currently priced at $61.65, Quant has gained 3.24% at press time. The key resistance level stands around $80.38, which, if breached, could signal a renewed bullish trend.

Additionally, crowd sentiment at 0.29 and smart money sentiment at 0.86 both reflect an optimistic outlook, suggesting that market participants anticipate an upward move. Therefore, the upcoming price action could be decisive for Quant.

Source: TradingView

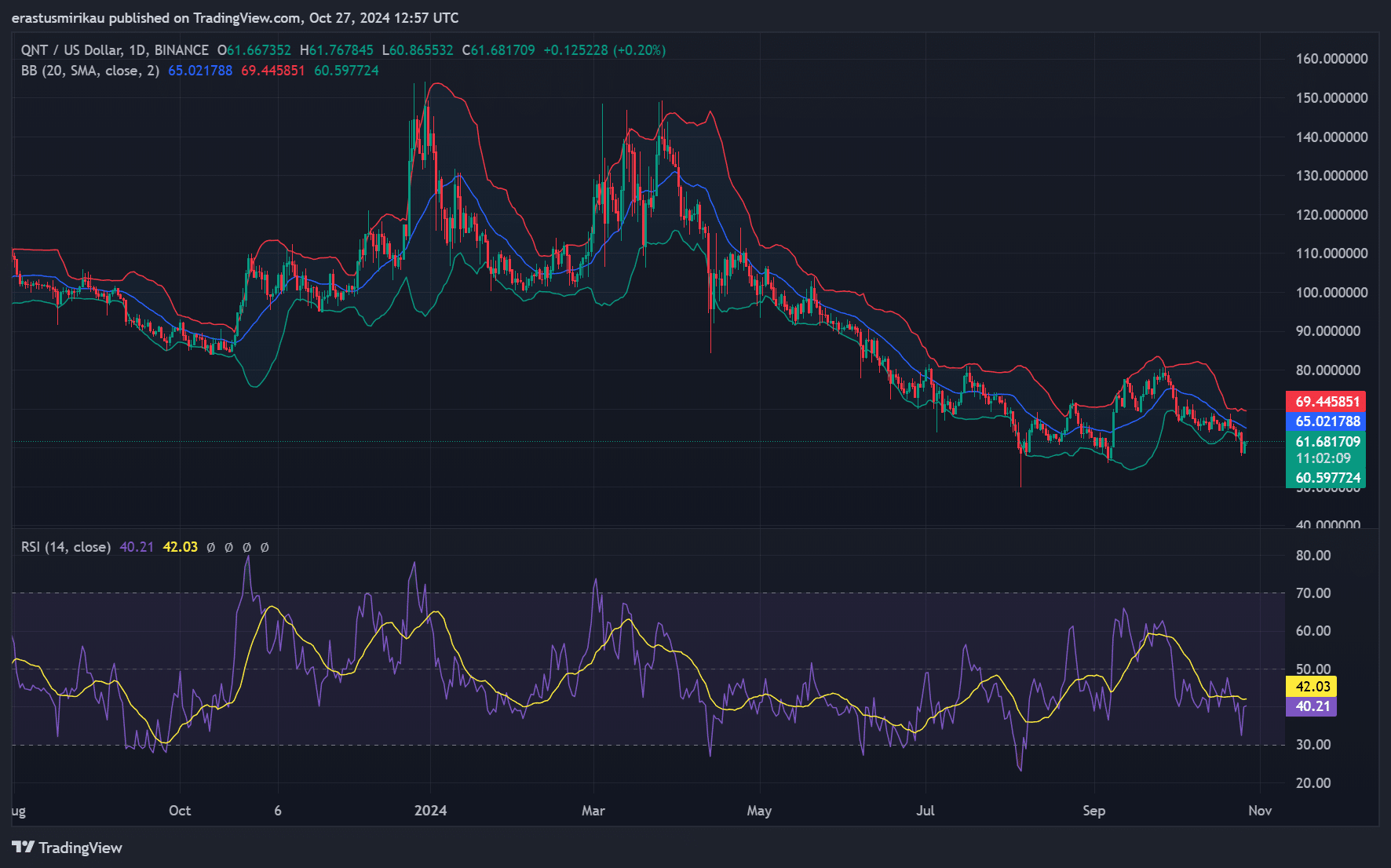

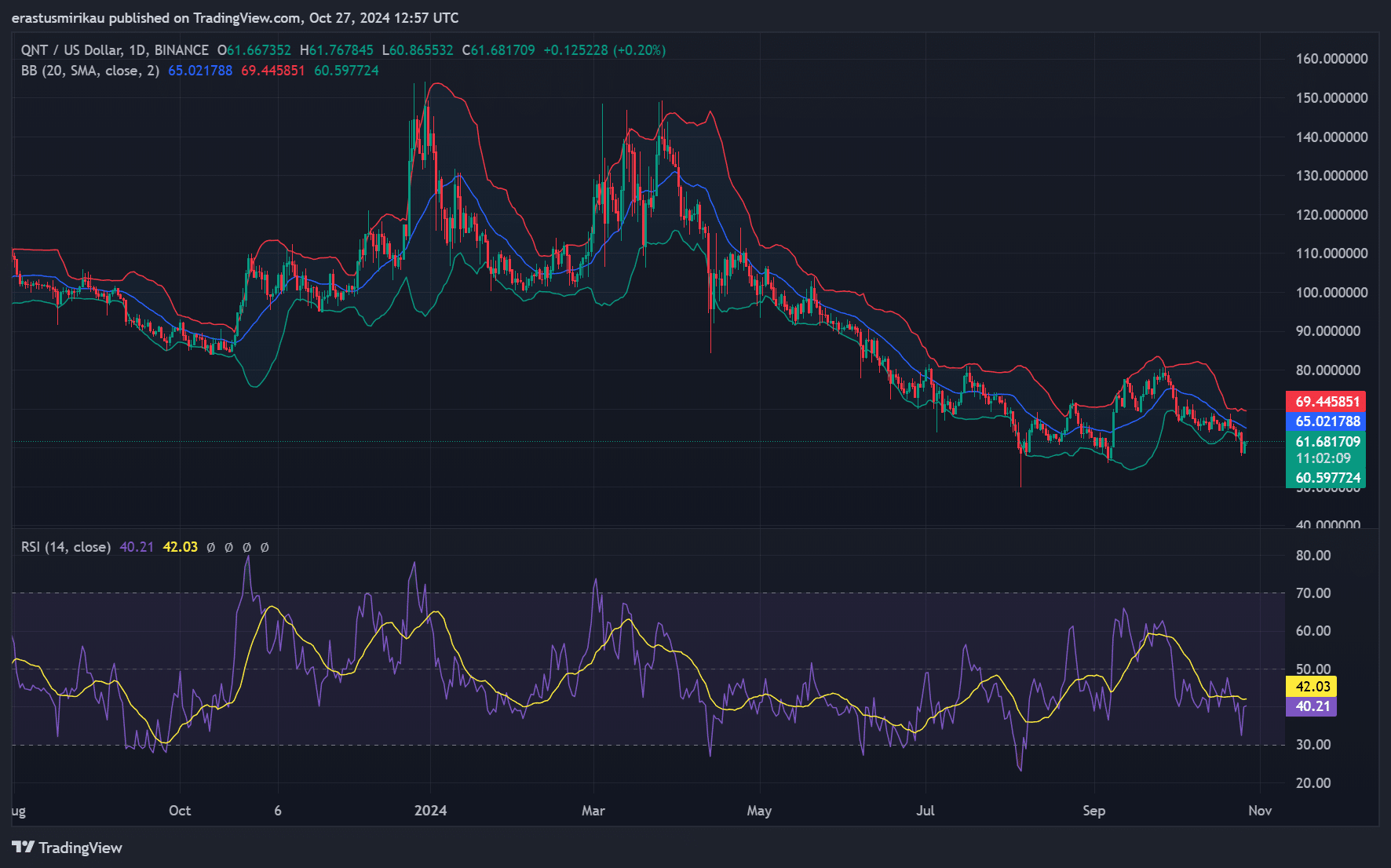

Key technical indicators: Bollinger Bands, RSI add weight to bullish sentiment

Examining QNT’s technical indicators further supports a potential breakout scenario. The Bollinger Bands on the daily chart show that Quant has been trading near the lower band.

This position generally suggests oversold conditions, which often lead to a reversal as buyers step in.

Additionally, the Relative Strength Index (RSI) currently sits at 42, indicating that Quant is just exiting oversold territory. If the RSI continues to move upwards, it will likely attract more buying interest, increasing the probability of a breakout.

Both indicators suggest a market gearing up for upward momentum, though breaking past resistance remains critical.

Source: TradingView

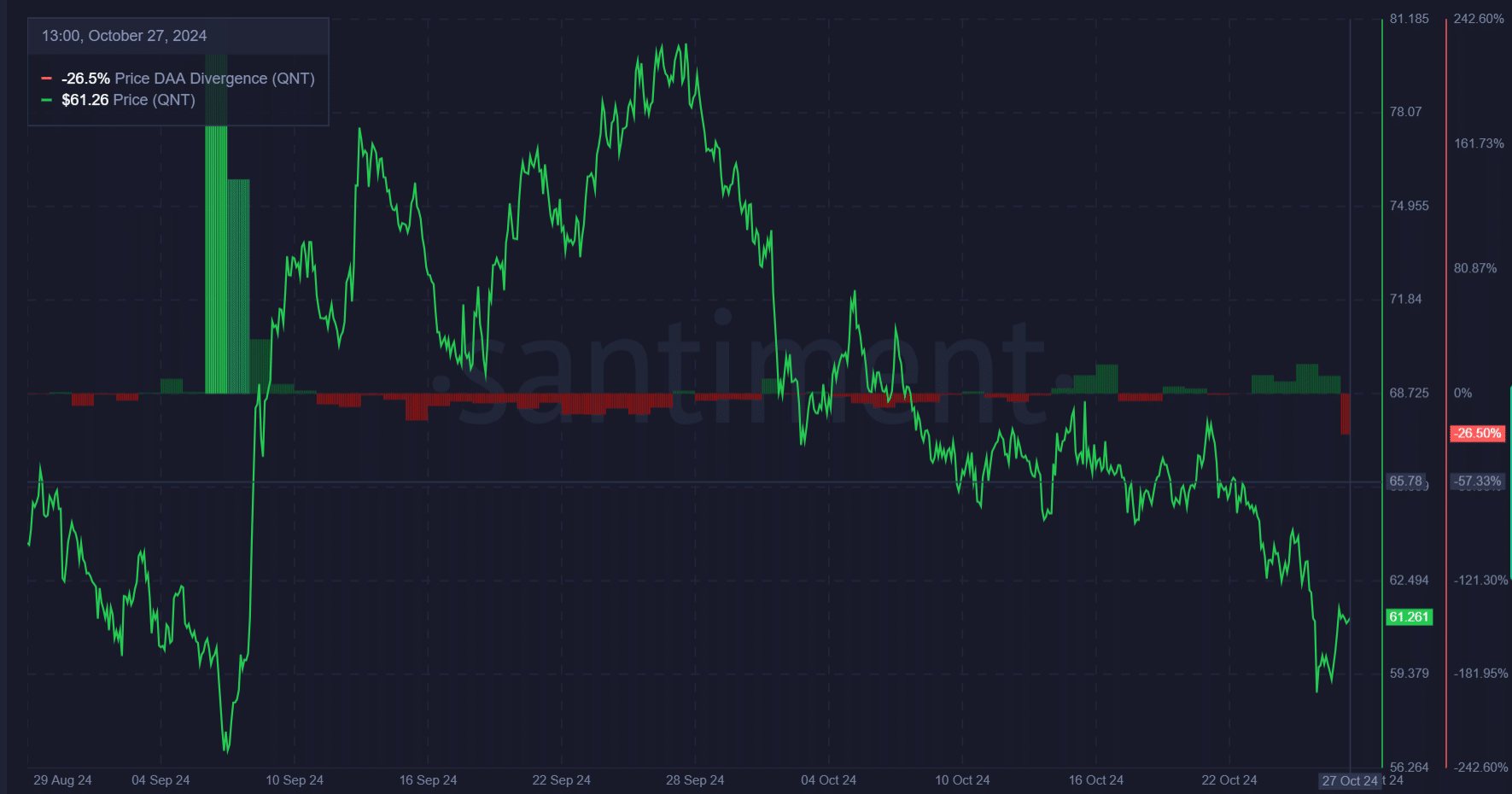

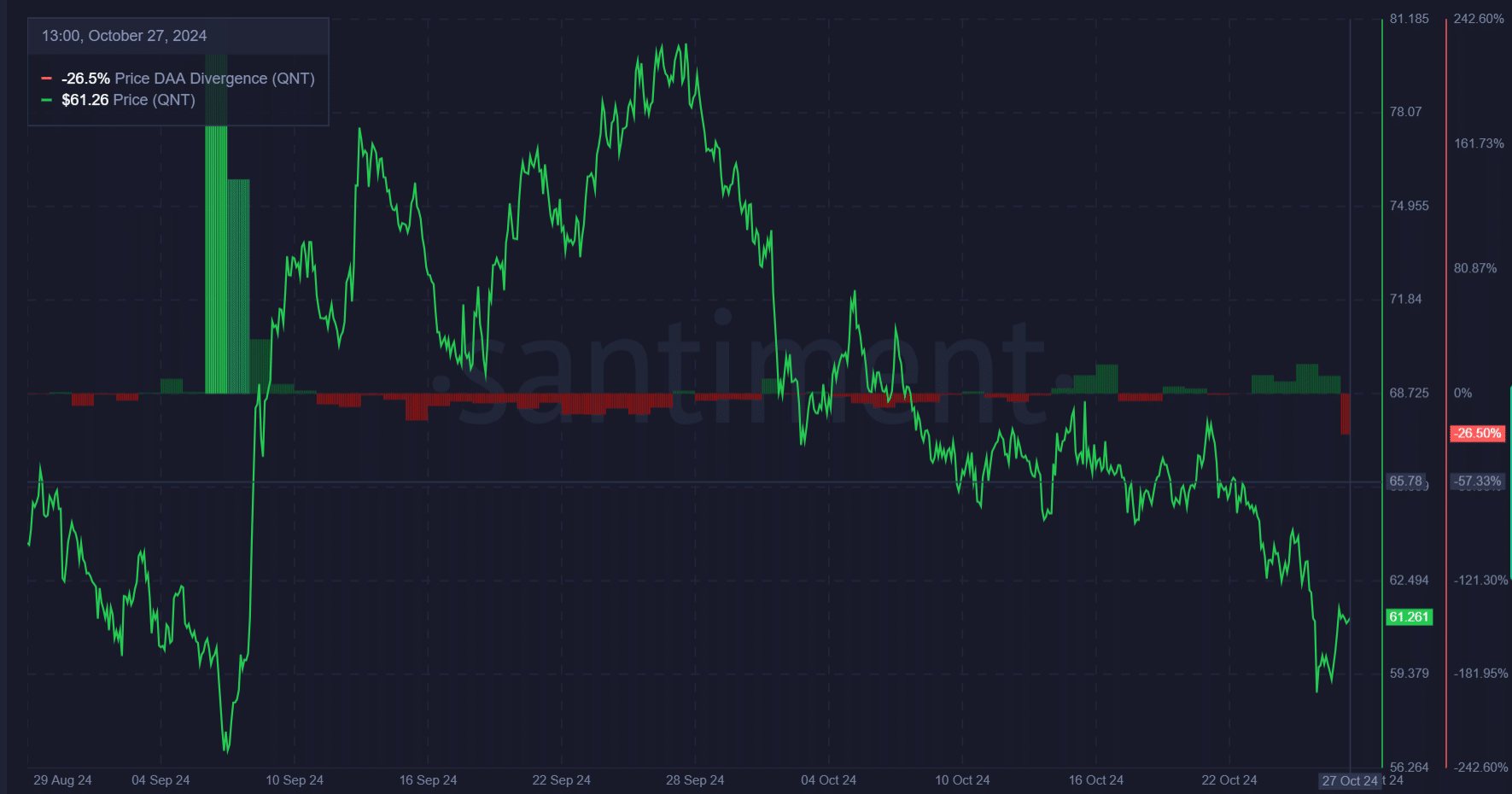

QNT price and DAA divergence: Is a network boost needed?

Interestingly, QNT’s price action shows a divergence with Daily Active Addresses (DAA), a key on-chain metric. With DAA divergence at -26.5%, the current network activity lags behind the recent price increase.

This divergence often implies that although price shows strength, network engagement needs to catch up to sustain a rally.

Therefore, a narrowing of this gap between DAA and price could strengthen bullish momentum. Aligning price and DAA trends would foster a more solid foundation for QNT’s potential breakout and reduce the likelihood of a short-lived rally.

Source: Santiment

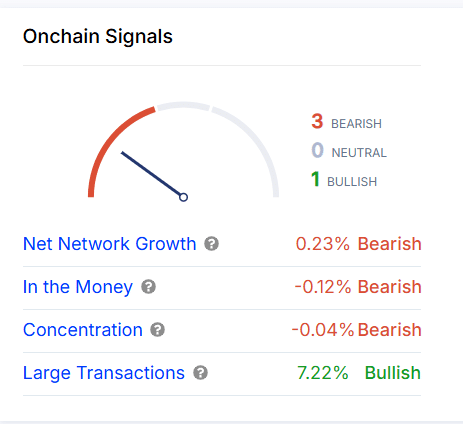

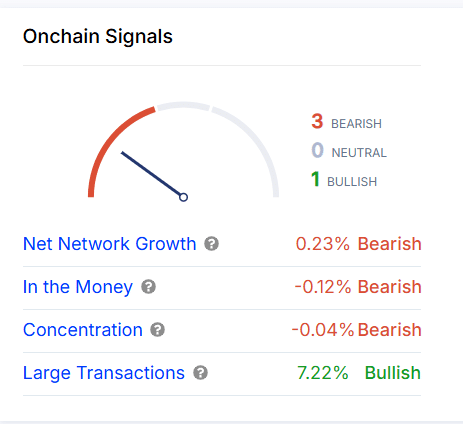

On-chain signals: Mixed indicators, but large transactions bullish

Examining other on-chain signals offers a mixed outlook. Metrics such as net network growth (+0.23%), in-the-money addresses (-0.12%), and concentration (-0.04%) indicate mild bearish tendencies.

However, large transactions—up by 7.22%—show notable bullish interest, suggesting that larger holders are accumulating. Consequently, this could create a stable support base, potentially paving the way for a more robust price movement if other metrics improve.

Source: IntoTheBlock

Read Quant’s [QNT] Price Prediction 2024–2025

With crowd sentiment, smart money, and technical indicators supporting an optimistic outlook, QNT appears poised for a breakout.

A successful move above $80.38 could ignite a rally, sparking renewed interest across the market. However, aligning on-chain activity with price gains will be essential for sustaining any bullish trend.