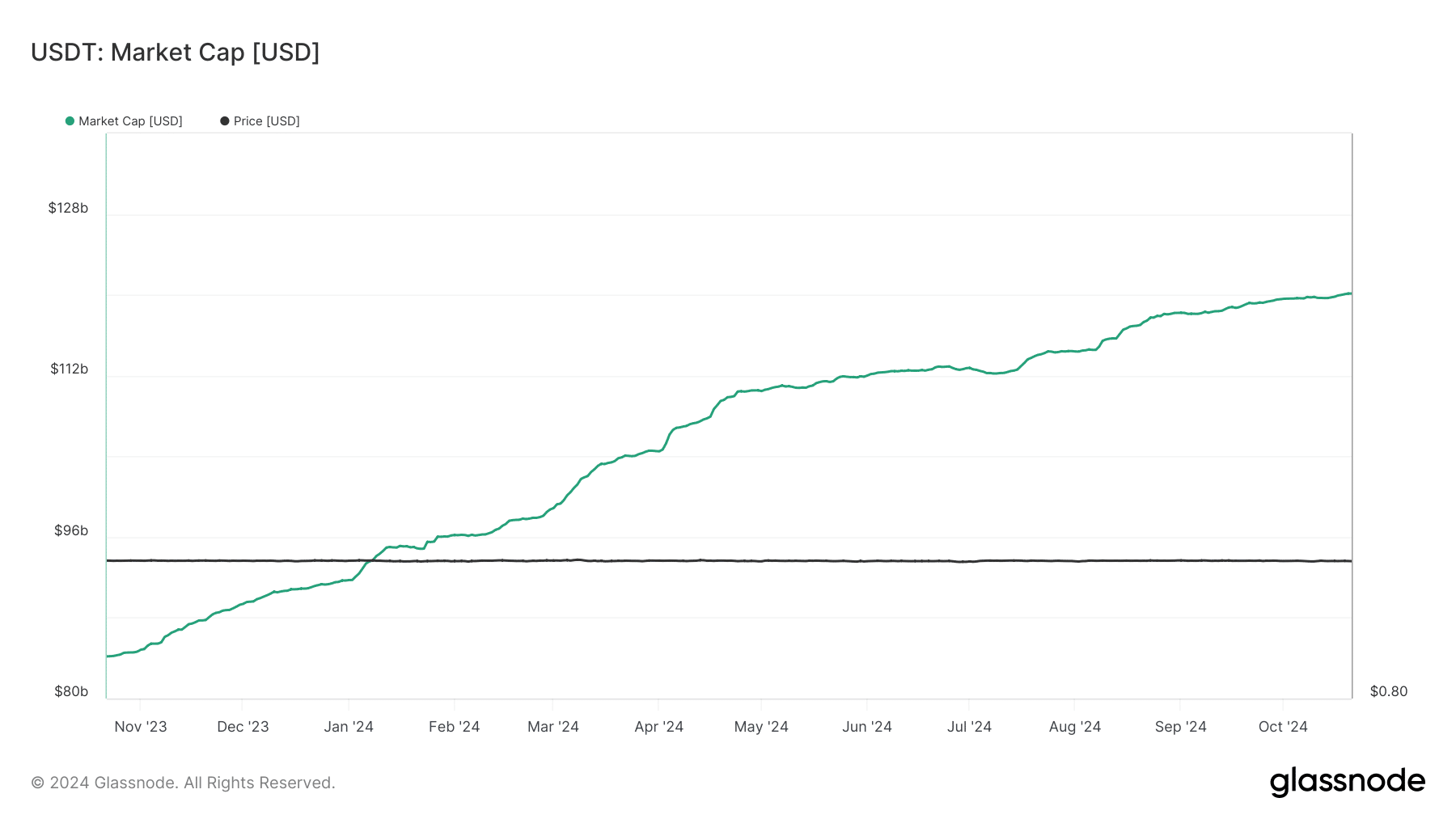

- USDT’s market cap has grown by over $28 billion in the past nine months.

- Tron dominates USDT transaction volume, capturing over 70%.

The USDT market cap has hit an impressive $120 billion, reaffirming its dominance as the largest stablecoin by market cap.

Despite growing competition in the stablecoin space, USDT continues to expand, especially on the Ethereum and Tron networks, where it sees significant trading volume and user activity.

USDT market cap surges to over $120 billion

A recent analysis of the USDT market cap on Glassnode shows notable growth over the past several months.

Source: Glassnode

At the start of the year, its market capitalization stood at approximately $92 billion. That figure has climbed to over $120 billion at press time. This means USDT has added more than $28 billion to its market cap in just nine months, reflecting its strong demand and usage.

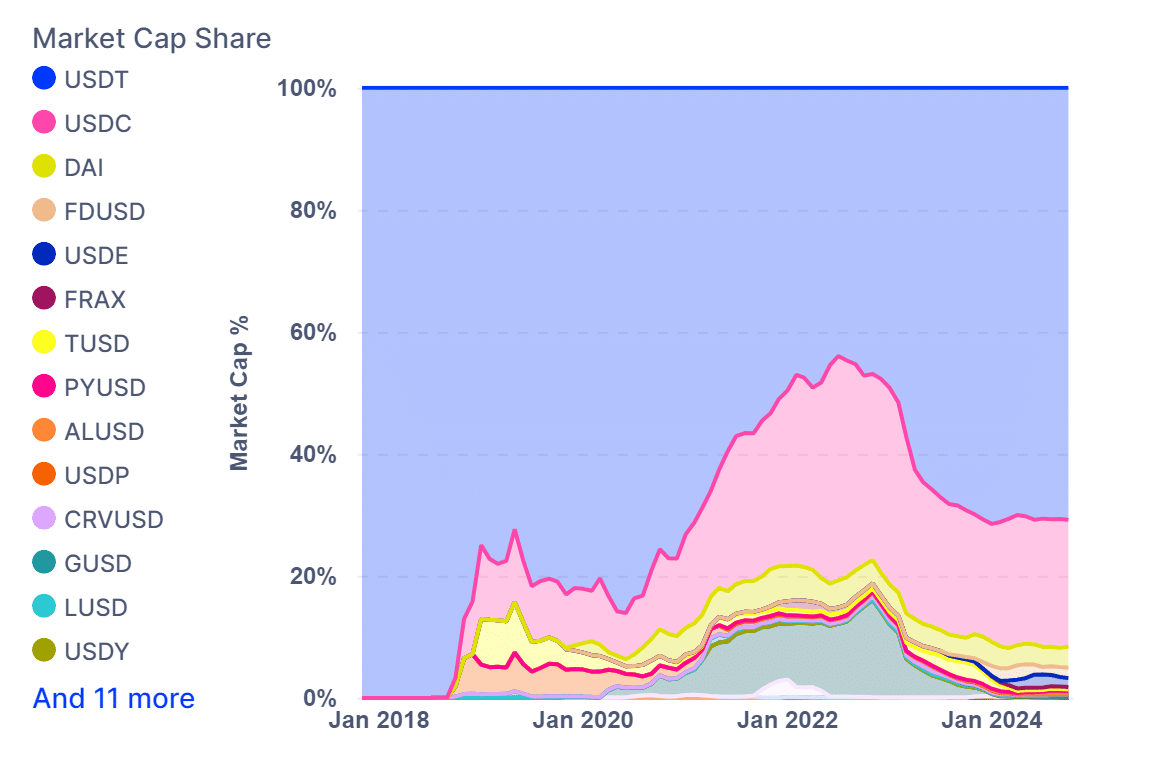

USDT’s market cap dominates other stablecoins

According to data from IntoTheBlock, USDT holds the top spot in market cap and leads in trading volume among stablecoins.

Most of its transactions occur on the Ethereum and Tron networks, with Tron commanding more than 70% of USDT’s transaction volume.

While Ethereum remains popular for USDT transactions, its high gas fees have pushed many users toward Tron, which offers lower fees and faster transaction times.

Source: IntoTheBlock

Layer 2 solutions, such as Arbitrum and Optimism, are also increasingly supporting USDT transactions, adding to its growing presence across various blockchain networks.

USDC, the closest competitor to USDT, trails behind in both market capitalization and transaction volume, solidifying USDT’s position.

What’s next for USDT?

As USDT crosses the $120 billion threshold, the stablecoin faces increasing competition from other stablecoins like USDC.

However, with its deep liquidity, strong user base, and presence on multiple blockchains, USDT is well-positioned to maintain its dominance in the stablecoin sector.

The future of USDT’s growth will depend on its ability to navigate evolving regulatory challenges and maintain transparency regarding its reserves. However, with no signs of slowing down, USDT continues to lead the stablecoin market, solidifying its place.