- Bullish momentum and buying pressure suggested that Litecoin is likely to climb towards $74 and beyond

- A move beyond $82 would suggest that a long-term uptrend is possible

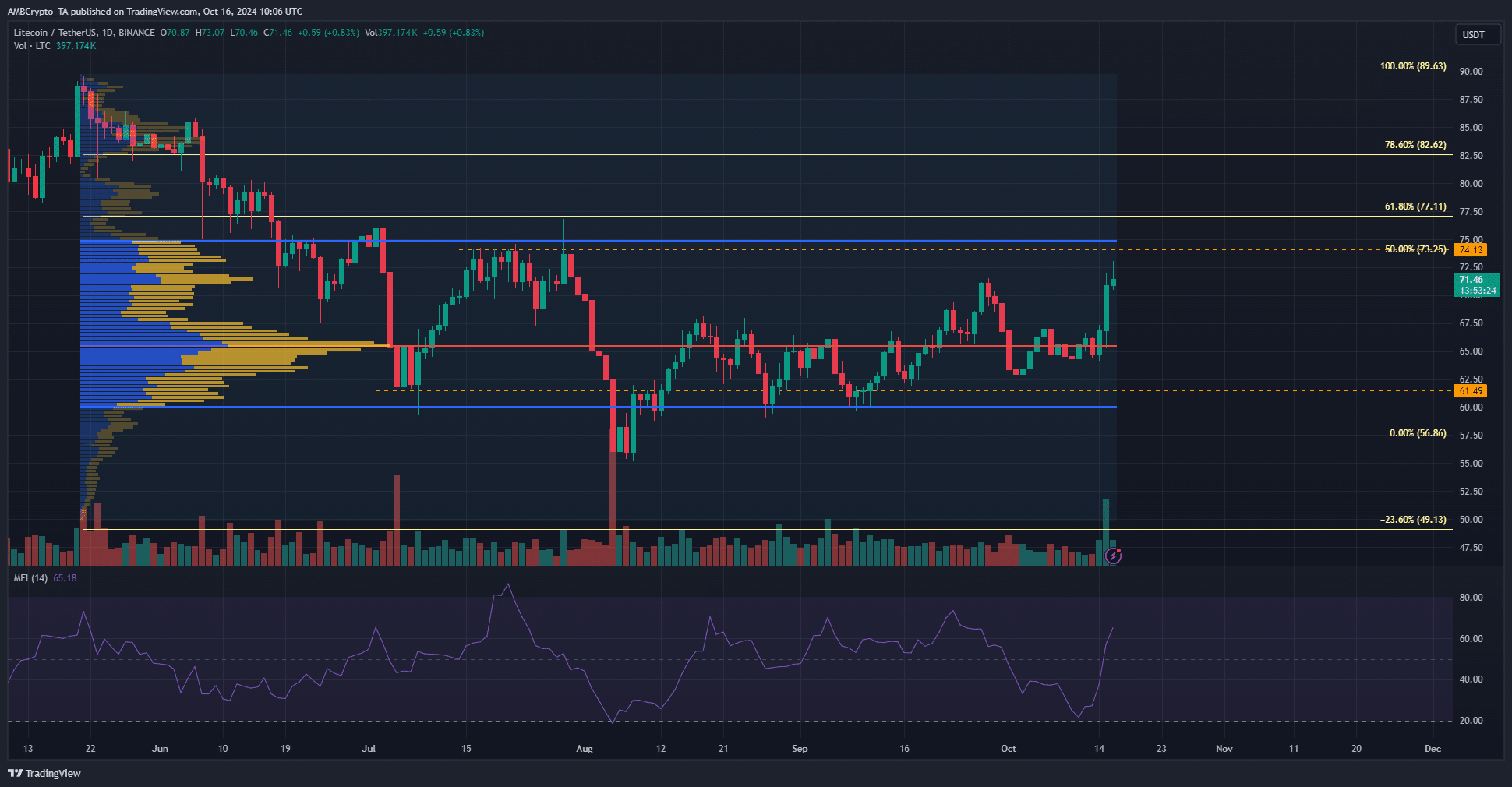

Litecoin [LTC] traded within a range between the $60 and $74.9 levels. Over the past two weeks, the bulls have made a valiant effort to drive prices past the Point of Control (POC) and keep them there.

With momentum and volume in favor of the buyers, at press time, it seemed likely that the move could reach higher. Here’s where traders could look to take profits, and where a long-term uptrend might establish itself.

Volume profile range highs and Fibonacci level have confluence

Source: LTC/USDT on TradingView

The Fixed Range Volume Profile revealed that the POC was at $65.5. Since August, Litecoin has crossed this level multiple times, but the bulls have been relatively stronger over the past month. The MFI highlighted bullish momentum and buying pressure, but was not near overbought conditions yet.

The FRVP’s high was at $74.9, just above the 50% Fibonacci retracement at $73.25. LTC bulls could take a while to clear these resistance levels due to their importance in recent months.

The downtrend of Litecoin since May means that a move beyond $82.6, the 78.6% retracement level, would be necessary to usher in a long-term uptrend.

Is Litecoin about to face reversal?

Source: Coinglass

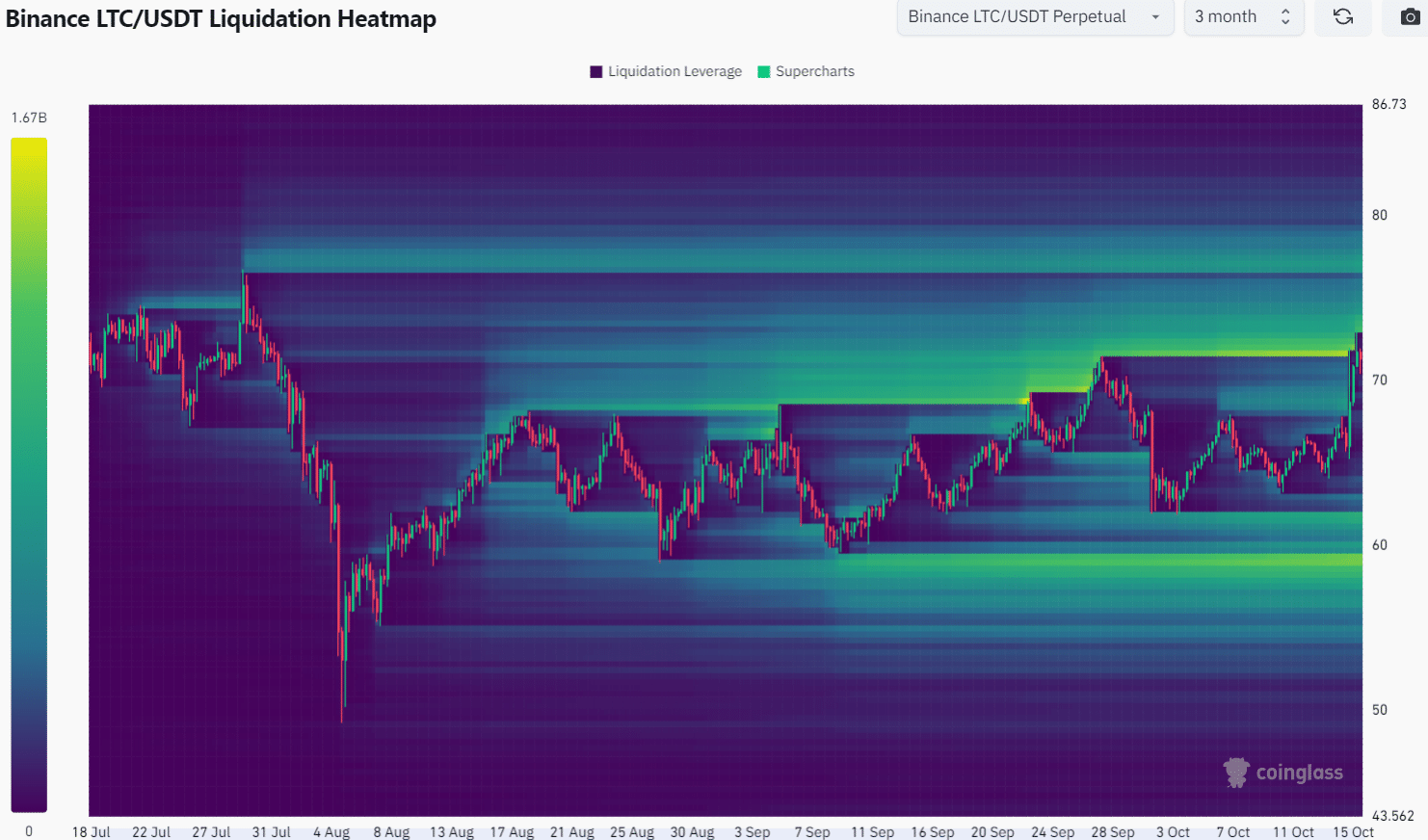

The 3-month liquidation heatmap showed that the $71.7-$72.8 region has been an important liquidity pocket. However, in the past 24 hours of trading, while LTC climbed to $73.07, it fell to $71 once again.

Read Litecoin’s [LTC] Price Prediction 2024-25

This liquidity cluster extends to $75, but is less dense. Therefore, a price move beyond $75 would be the first sign that there is a strong likelihood of a breakout past $82. Especially as it would indicate bullish strength.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion