- Bitcoin ETFs recorded $555.9 million in inflows on the 14th of October, the highest since June.

- ETFs held 869,000 BTC, about 4% of Bitcoin’s circulating supply.

On the 14th of October, Bitcoin [BTC] ETFs saw record-breaking inflows, with a total value of $555.9 million—their largest daily net inflow since June, according to Farside Investors.

This surge in ETF interest coincided with BTC reaching a two-week peak. The coin was trading at $66,500, at press time.

Fidelity’s FBTC led the charge and logged an impressive $239.3 million, marking its highest inflow since the 4th of June.

Other notable ETFs included Bitwise’s BITB with inflows of $100.2 million, BlackRock’s IBIT at $79.5 million, and Ark 21Shares’ ARKB with just under $69.8 million.

Grayscale’s GBTC had its first influx in October, at $37.8 million, the largest since May.

Execs weigh in…

Remarking on the same, ETF Store President Nate Geraci noted,

Source: Nate Geraci/X

Since their debut in January, BTC ETFs have amassed a notable $18.9 billion net inflows.

Excluding GBTC, the nine new Bitcoin ETFs owned around 646,000 BTC, with GBTC adding 223,000 BTC to the total.

These funds control 869,000 BTC, roughly 4% of Bitcoin’s circulating supply.

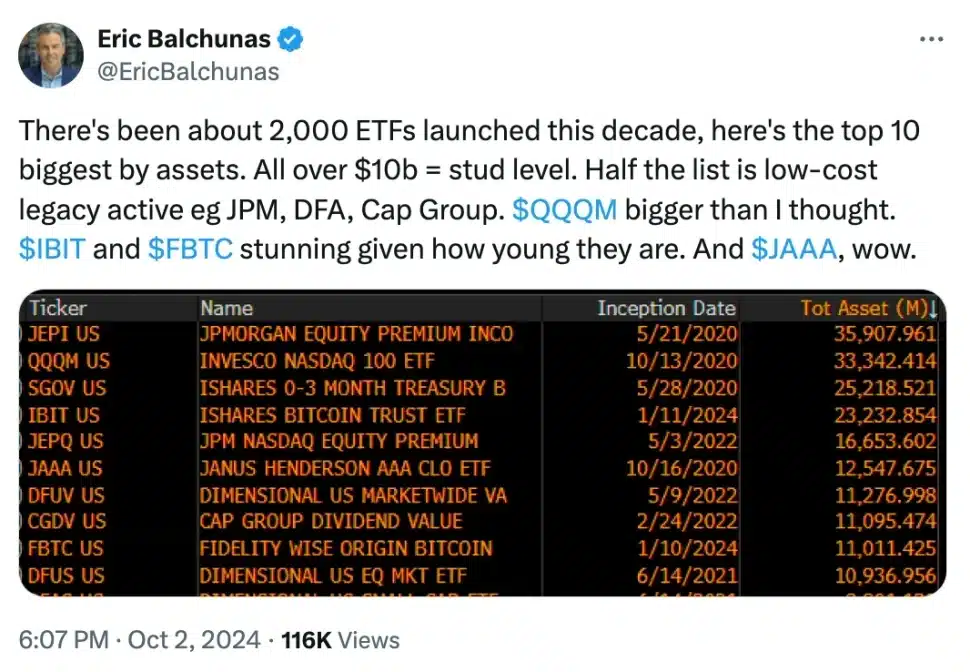

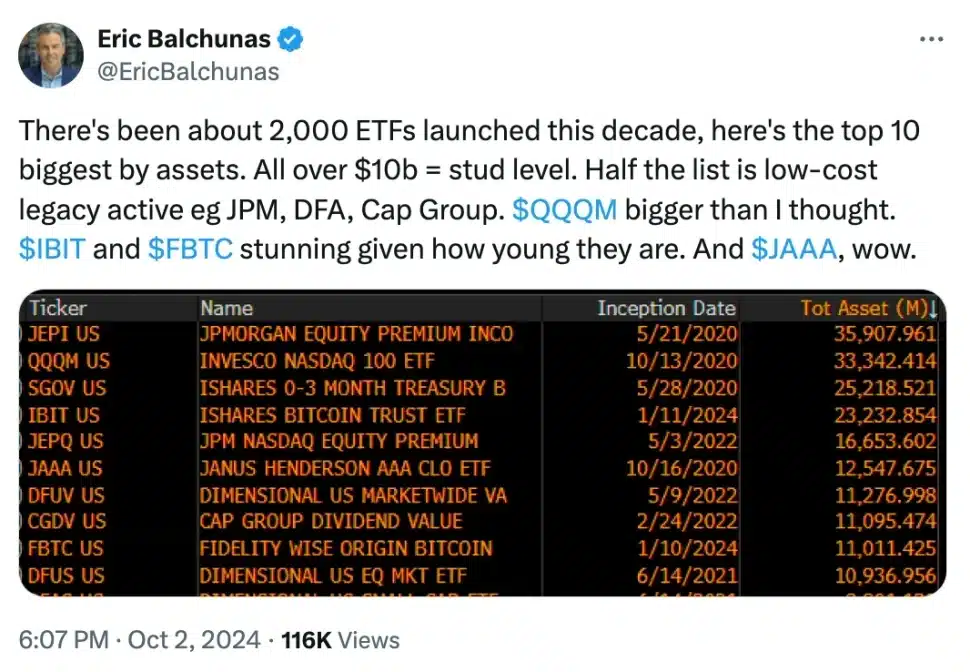

This year has seen remarkable growth in the ETF sector, with around 2,000 launches. This includes top funds like BlackRock and Fidelity. Remarking on the matter, Bloomberg’s Eric Balchunas said,

Source: Eric Balchunas/X

Lingering concerns

However, despite recent growth, BTC ETFs represent only a small slice of the total Bitcoin trading landscape.

According to Checkonchain data from the 11th of October, the Bitcoin Futures market recorded $53.4 billion in trades, with the spot market reaching $4.5 billion.

In contrast, ETF trades totaled just $2 billion, capturing approximately 3% of the day’s overall BTC market volume.

This little fraction demonstrates ETFs’ infancy in the larger Bitcoin market ecosystem.

Well, this is also because determining the exact share of ETF inflows driven by the “basis trade,” or cash and carry trade, remains challenging.

Major players in the ETF market

Major institutions like Goldman Sachs and Jane Street Capital are engaged in creating and redeeming ETF shares, which stabilizes the ETF’s price and liquidity.

Hedge funds, such as Millennium Management and Capula Management, employ “basis trading” strategies to profit from discrepancies between Bitcoin’s spot and futures prices.

However, not all large holders engage in basis trading.

For example, the State of Wisconsin Investment Board holds the ETF for purposes like portfolio diversification.

Yet, Bernstein, a private wealth management firm, suggests that basis trades could act as a “Trojan horse” for broader adoption, as increased liquidity and trading volume may encourage investors to adopt long-term positions in Bitcoin.

What’s next?

Therefore, if options tied to IBIT are approved and physically settled, it would attract more sophisticated investors.

And, for that, strategies like covered calls (selling call options while holding the underlying asset) would allow investors to generate passive income, while miners could use these options to hedge their holdings.

Together, these elements could bring more maturity and volume to the Bitcoin ETF market.