- DIA has a strongly bullish structure and high buying pressure.

- The rejection from the weekly resistance and the 16% drop meant the market could be overextended.

Decentralized Information Asset [DIA] has rocketed higher on the price charts. Since the 29th of September, the token has gained 68% and the trade volume on Monday was sixteen times its volume on the 28th of September.

The token ran into a resistance zone on the weekly chart after these huge gains. The Bitcoin [BTC] move has aided DIA’s sentiment. Should long-term holders cash out, or wait for greater gains?

The case for a sustained move

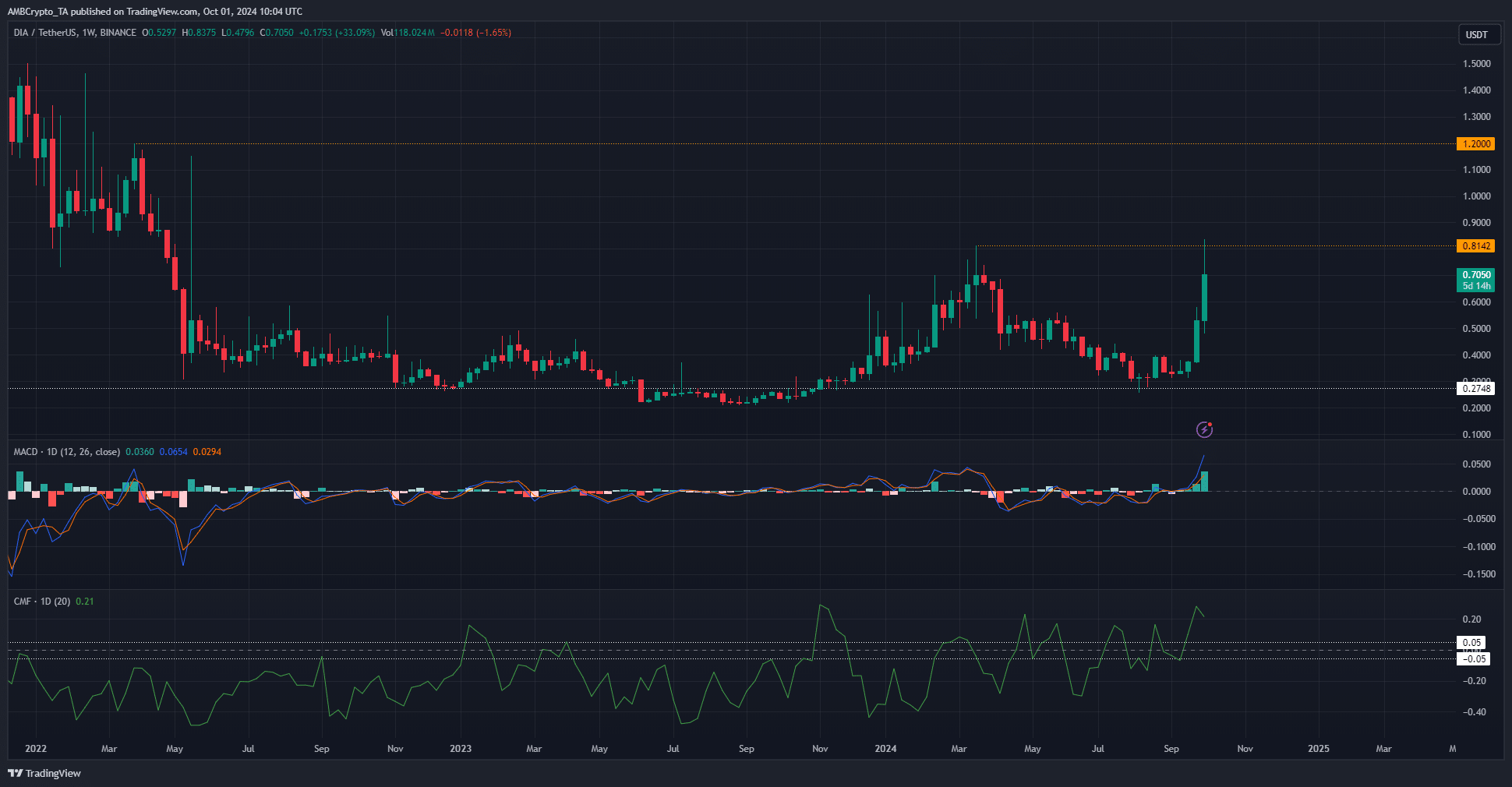

Source: DIA/USDT on TradingView

The strong, quick surge higher has left many traders sidelined and scrambling to take part in the rally DIA is on.

This surge in interest could push DIA higher, but is also likely to induce volatility due to activity in the futures market from overeager, late bulls.

The move to $0.81 was followed by a rejection, and the price is down 16% from the local high it made at $$0.837. The indicators on the daily timeframe supported the bullish outlook.

The CMF reached highs last seen during November 2023, and the MACD surged higher than it has since September 2021.

But they are lagging indicators, and hence will follow the price and do not predict the next move.

Arguments for the recent surge marking a local top

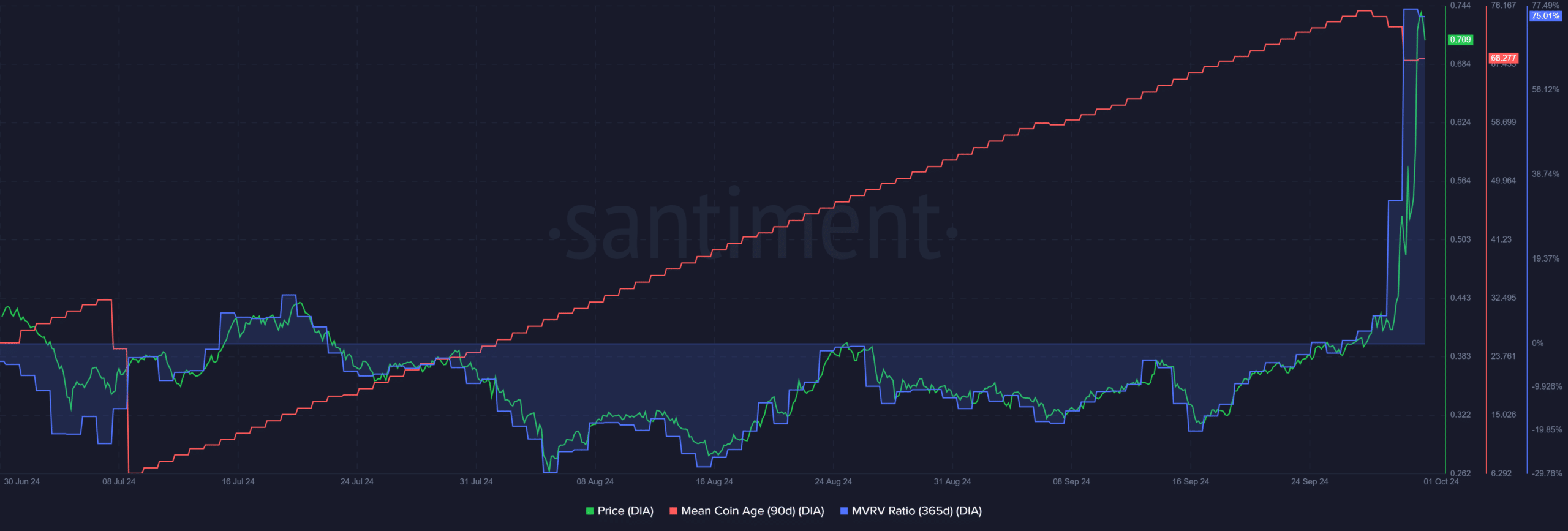

Source: Santiment

The weekly price chart showed that a retracement to $0.54-$0.38 is possible, being the 50% and 78.6% Fibonacci retracement levels.

Since many traders were left sidelined due to the suddenness of the move, a retracement and consolidation could give time for the next rally over the coming months.

The mean coin age has trended higher since July, showing accumulation. The 365-day MVRV ratio showed that 75% of the holders during this period were in profit.

Realistic or not, here’s DIA’s market cap in BTC’s terms

This could lead to intense profit-taking activity and a price slump.

AMBCrypto believed that the bulls are unlikely to force prices past the $0.81 zone. The market is likely overextended, and a retracement toward key Fib levels could cause the next rally.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion