- Render price surged by 23% in the past week, breaking key resistance.

- Large transactions and social volume spike, signaling increased market activity.

Render [RENDER] has witnessed an exceptional rally of 23% in the last 7 days. This clearly indicates a significant shift in momentum in the market.

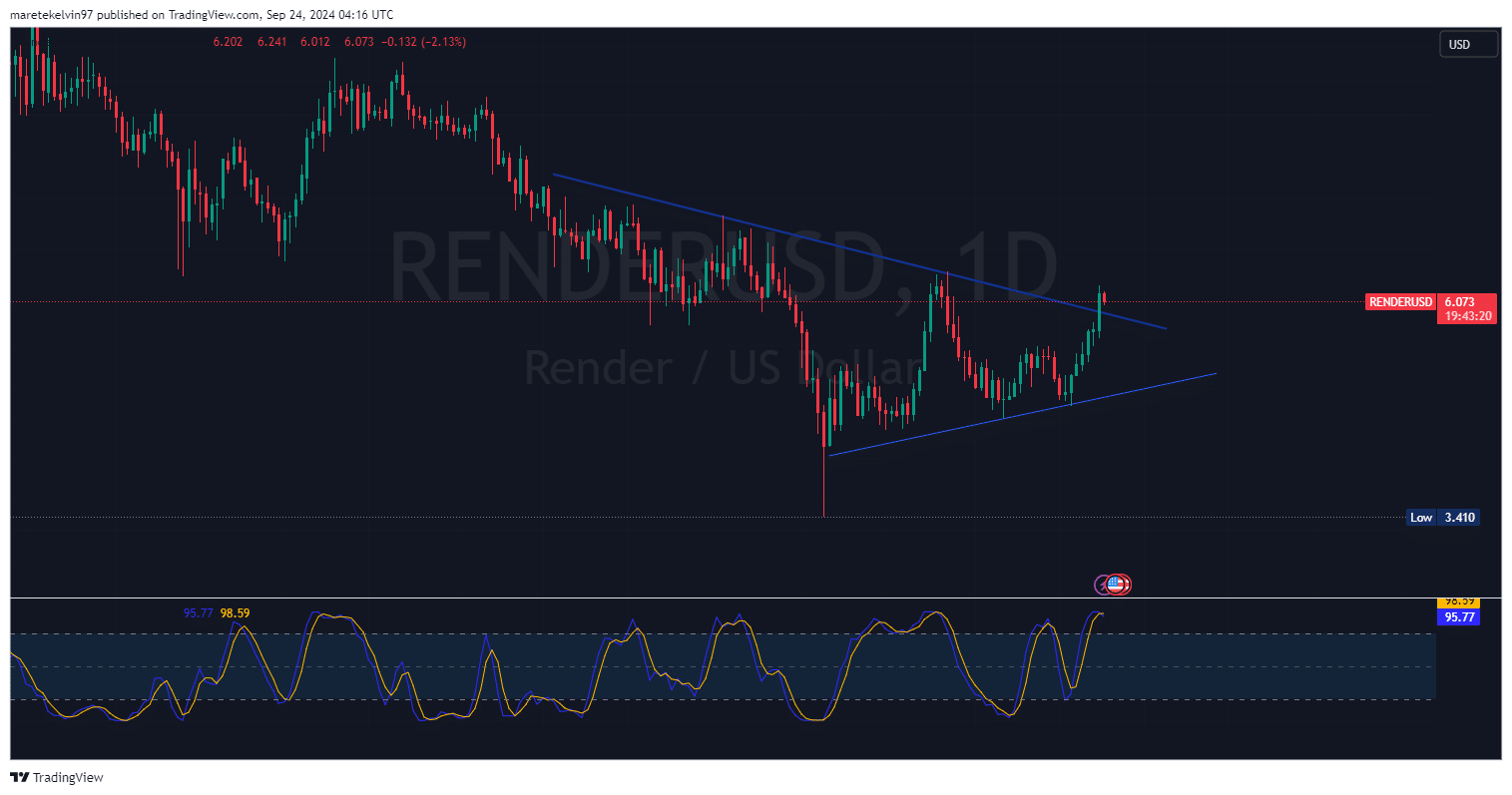

The recent bullish rally has convincingly broken out above a descending trendline that may have brought a structural change in the market. The breakout does indeed suggest that bulls have come into play, but will this trend continue uninterrupted?

Render market activity balances out

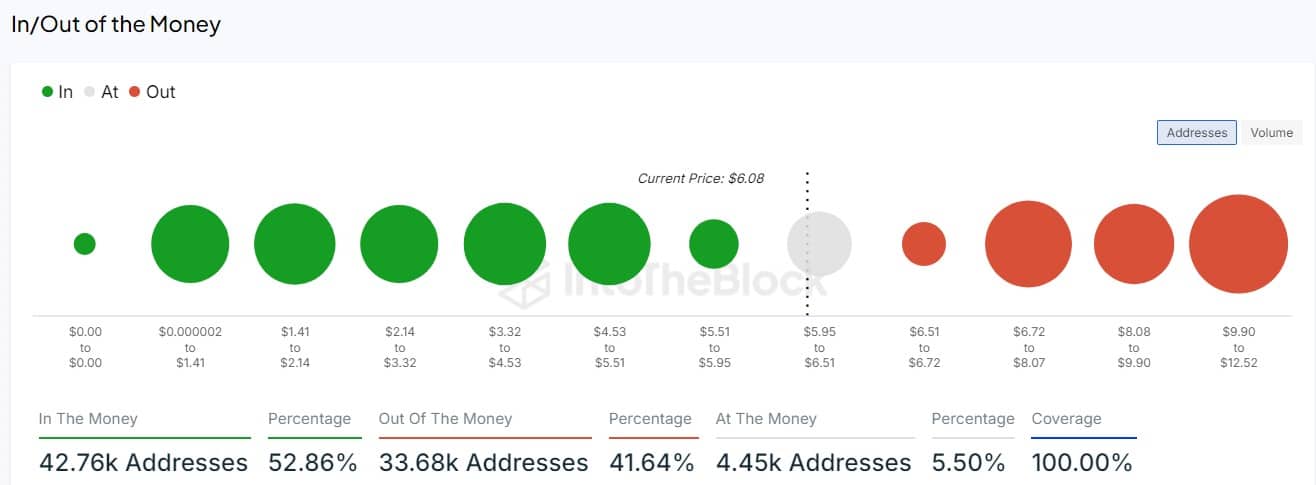

According to AMBCrypto’s analysis of IntoTheBlock data, the number of active addresses at profit stands at around 53%. This indicates a state of market equilibrium since it is within the 5% range from the 50% mark.

Source: IntoTheBlock

This balance between buyers and sellers would indicate that Render could consolidate before making the next move, probably a retracement to the recently broken trendline for the bullish momentum to continue and give the market a chance to catch its breath.

Source: Tradingview

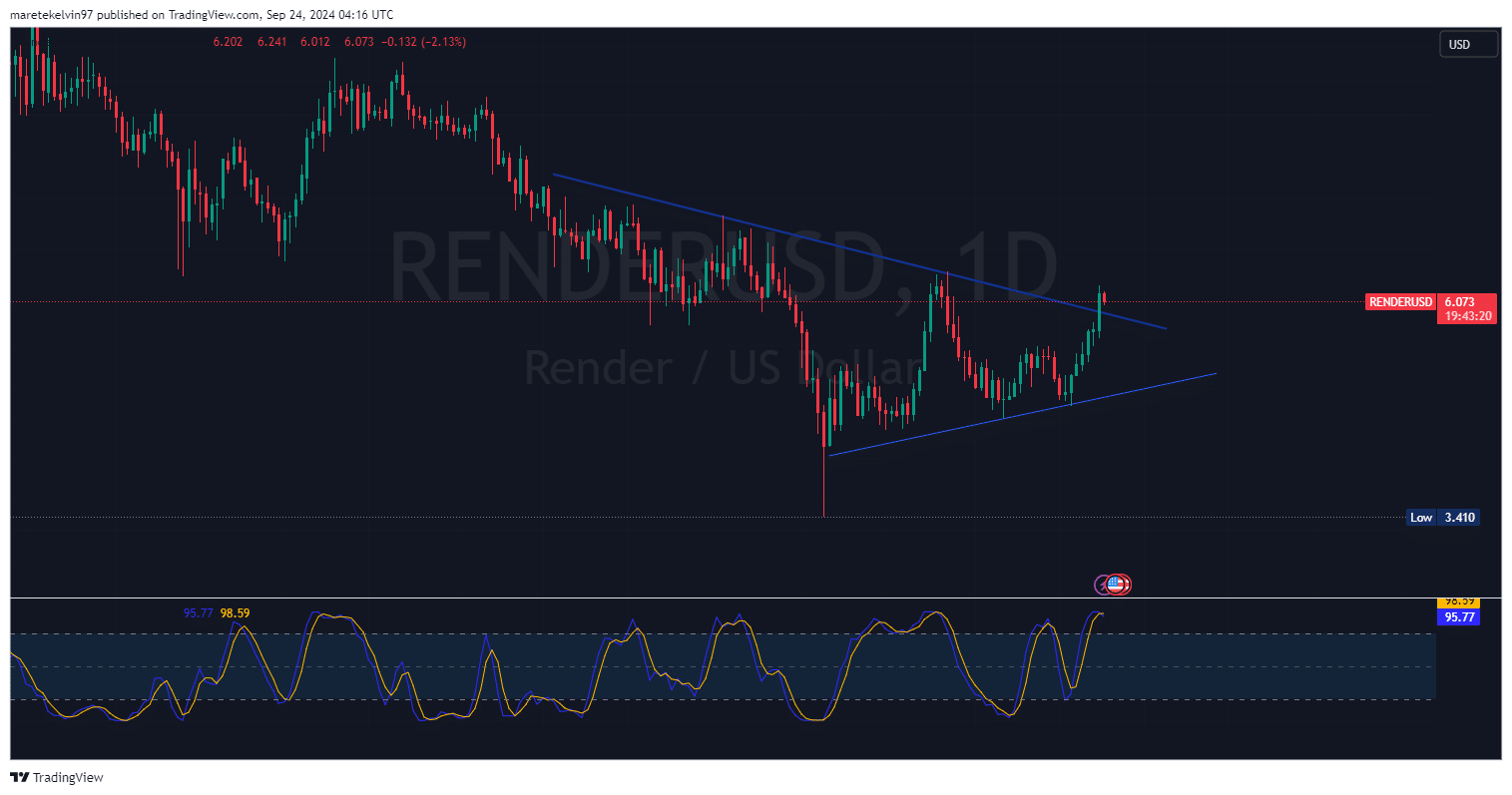

Spike in large transactions

Large transactions in Render significantly jumped in the last 48 hours. The markets had been at a stalemate previously, but this recent surge in high-value transactions reflects a renewed interest by institutional investors.

This can extend the uptrend of Render further and perhaps push the price higher in the near future.

Source: IntoTheBlock

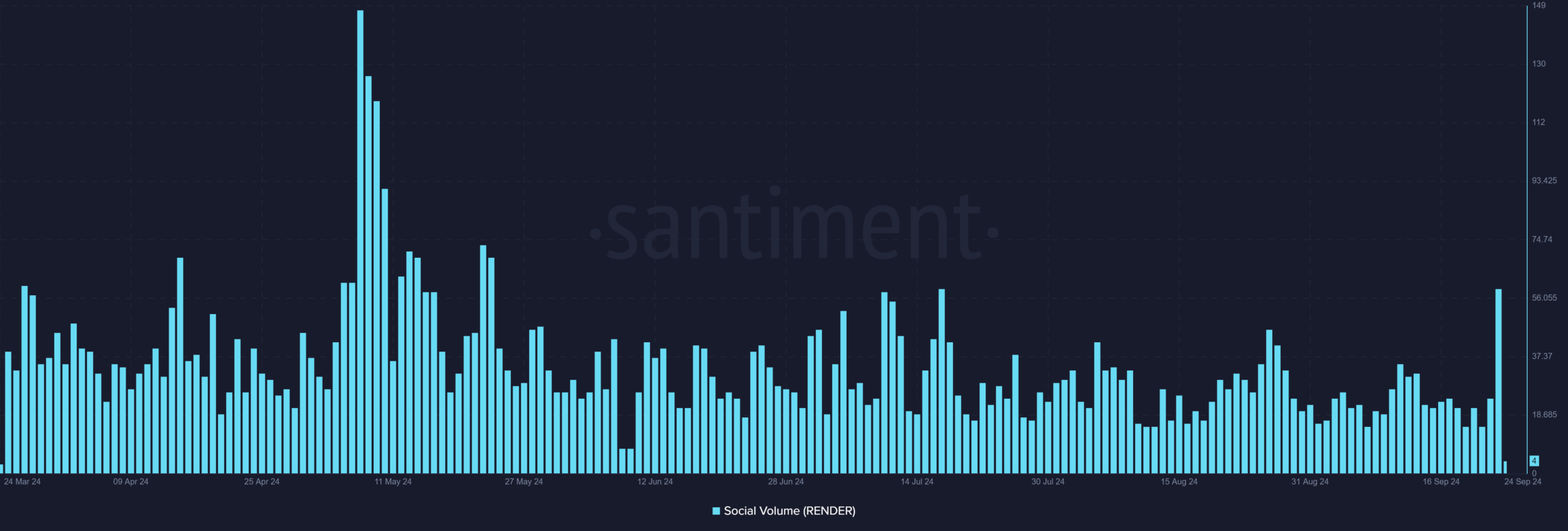

Social volume takes a positive turn

Social volume for Render has also increased significantly within the last 24 hours. Generally, an uptick in volume coincides with an uptick in retail interest, so this sudden surge may precede an increased attention from the broader crypto community.

Positive sentiment and increased engagement could eventually maintain the current rally and push the price further.

Source: Santiment

Is your portfolio green? Check the Render Profit Calculator

As Render continues to carry social waves by storm, the market is at a critical point. The combination of increased social volume and large transactions suggests more volatility ahead.

Investors should keep an eye on the descending trendline for a potential retracement, but the overall sentiment remains bullish.