- Bullish indicators form, but breaking $146 is crucial for a rally toward $180 or higher.

- Analysts are predicting a potential consolidation phase for AAVE.

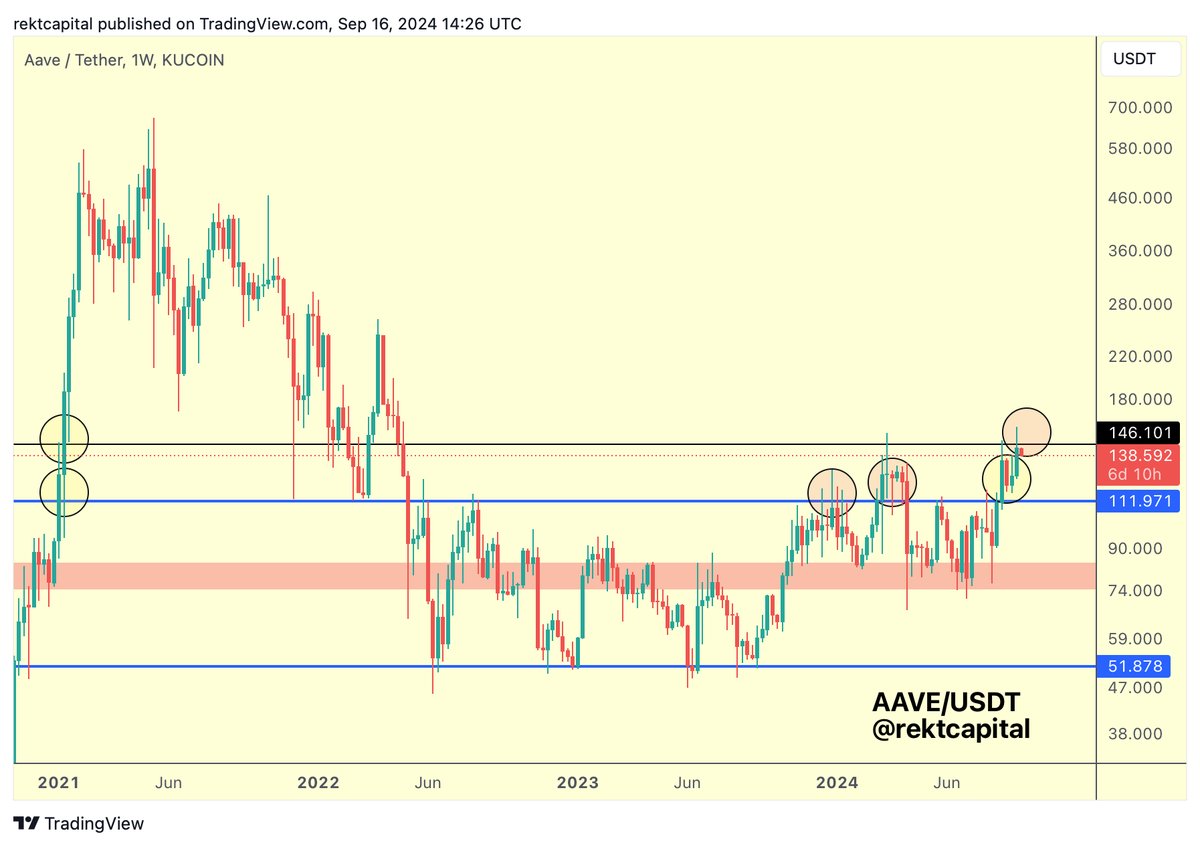

Aave’s [AAVE] recent attempt to break above the critical $146 resistance level was thwarted, marking another rejection at this pivotal point.

Crypto analyst Rekt Capital highlighted the importance of closing above $146 for a bullish breakout, noting that this crucial weekly close was missed. The consistent failure to overcome this level suggests that AAVE is not yet ready for a sustained rally.

The $146 price point has been a significant barrier since early 2022, with multiple failed attempts to close above it. The latest rejection signals the continued challenge for buyers, raising concerns that the market could remain range-bound for the near future.

Consolidation likely between $111 and $146

Following the latest rejection, analysts are predicting a potential consolidation phase for AAVE. The price may remain between the $111 support level and the $146 resistance, which has proven difficult to break.

This consolidation could see AAVE trading within this range until a decisive move either above resistance or below support occurs.

Source: X

For a bullish breakout to be confirmed, AAVE would need to secure a close above $146. If this occurs, the next price targets could be as high as $180, signaling renewed bullish momentum.

However, if AAVE fails to hold support at $111, it could lead to a drop towards the $90 level or lower, indicating further market weakness.

Despite these failed attempts, some bullish technical patterns are forming. AAVE’s chart shows an inverse head and shoulders pattern, a classic bullish reversal setup. Additionally, the price is breaking out from a falling wedge, a pattern that typically precedes upward movement.

These bullish signals suggest the possibility of a breakout, though the $146 resistance will need to be overcome first.

Technical indicators signal mixed momentum

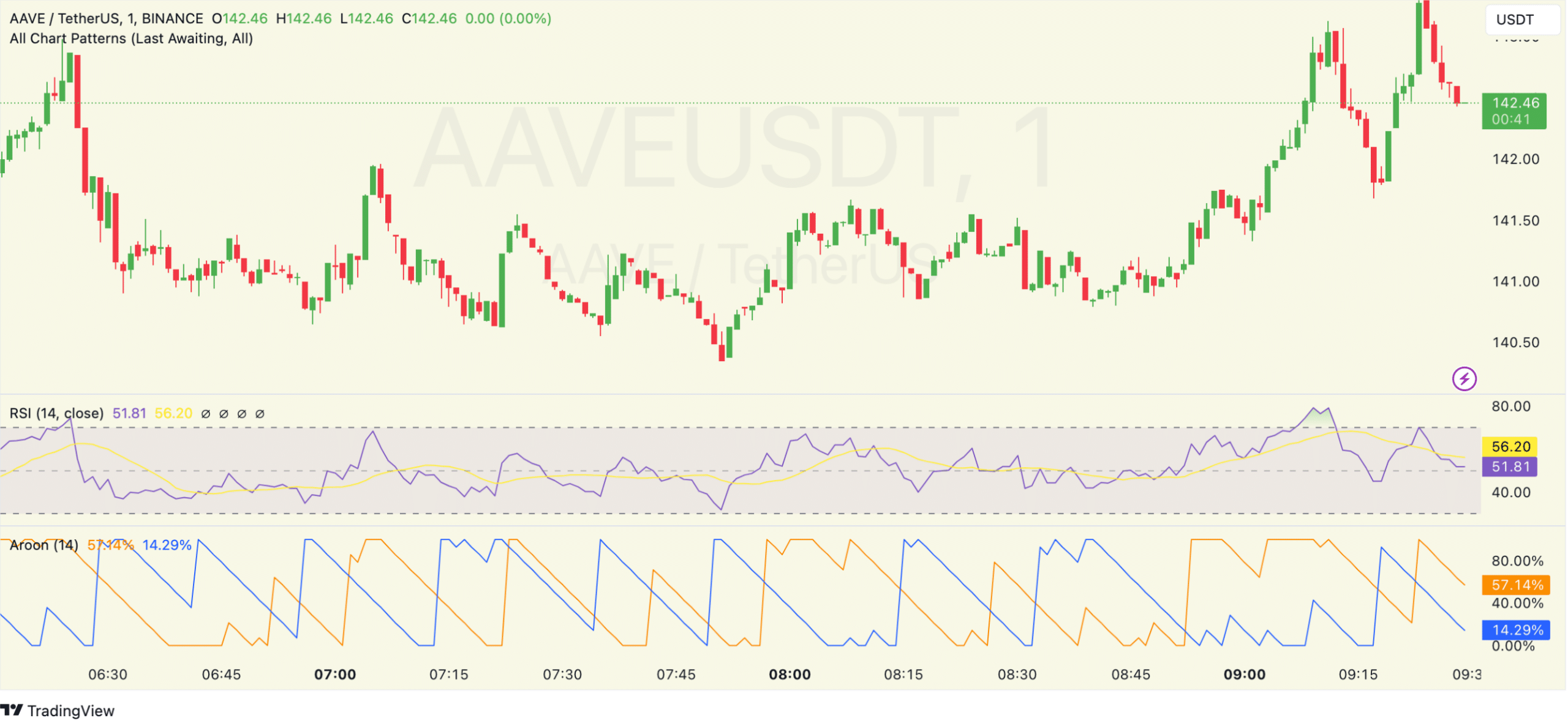

Although AAVE’s rejection at $146 is concerning, technical indicators point to some bullish momentum. The Relative Strength Index (RSI) currently sits at 65.09, indicating that buying pressure is building but has not yet reached overbought levels.

This suggests that there is still room for upward movement if the bulls regain control.

Source: TradingView

Moreover, the Aroon indicator shows a strong uptrend, with the Aroon Up line at 100%, signaling a clear upward push.

Meanwhile, the Aroon Down line is at 14.29%, indicating minimal selling pressure. These indicators provide some optimism for traders hoping for a breakout above the resistance level.

At the time of this publication, AAVE is trading at $141.56, with a 24-hour trading volume of $327.46 million. The circulating supply stands at 15 million AAVE, giving the token a market capitalization of $2.11 billion.

Read Aave’s [AAVE] Price Prediction 2024–2025

While the market shows some signs of a bullish reversal, the key $146 resistance remains a major hurdle that must be overcome before AAVE can confirm a sustained upward trend.

Traders are closely watching these levels, as a break above $146 could pave the way for a rally toward $180 and beyond.