- Binance plans to launch its Solana staking service by late September.

- SOL price reacted mildly amid overall weak market sentiment.

Binance, the world’s largest crypto exchange, has unveiled its new staking service for Solana [SOL], which will debut in late September. According to a recent press release, Binance will allow users to stake their SOL and earn rewards in exchange for its liquid staking token (LST), Binance Staked SOL [BNSOL].

According to Binance’s Vishal Sacheendran, Head of Regional Markets, the staking service will provide a seamless way of earning rewards.

‘As one of the first crypto exchanges to offer SOL liquid staking, Binance is providing a seamless and flexible way to earn rewards while allowing users to maintain full control over their staked assets.”

He added that,

‘Unlike native staking, which locks up assets, BNSOL allows users to unlock liquidity, enjoy continuous reward accumulation, and seamlessly participate in both the Binance platform and the broader DeFi ecosystem.’

Solana staking trend

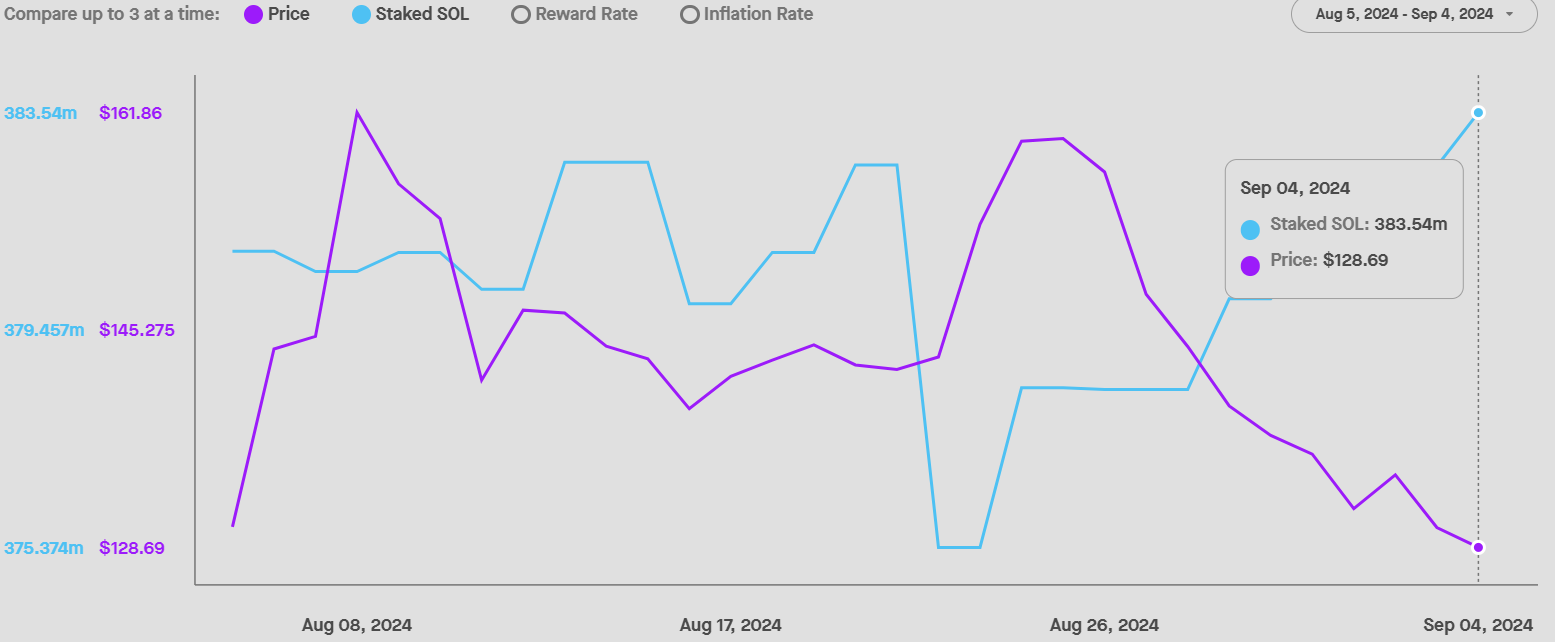

According to Solana Beach, 65% of SOL’s current supply, about 383.5 million tokens, have been staked. Per Staking Rewards data, nearly 10 million staked SOL tokens were added in late August.

Source: Staking Rewards

This trend could pick pace when Binance and other exchanges officially debut their liquid staking services. Interestingly, SOL price didn’t react to the announcement last week.

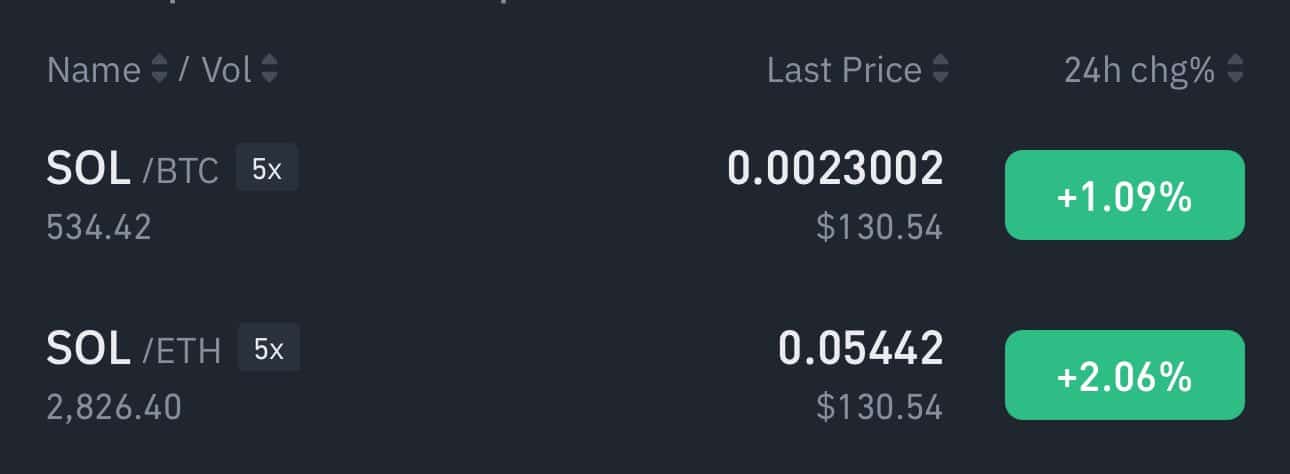

However, a notable price reaction coincided with the latest Binance update, as SOL rebounded strongly against Bitcoin [BTC] and Ethereum [ETH] pairs during the Asia trading session on Wednesday, the 4th of September.

Source: Solana Floor

Additionally, SOL was among the tokens that led the mid-week recovery with a strong surge in trading volumes.

However, the overall crypto market was still gripped by weak sentiment, and the update might drive a sustainable rally if BTC continues to post losses.

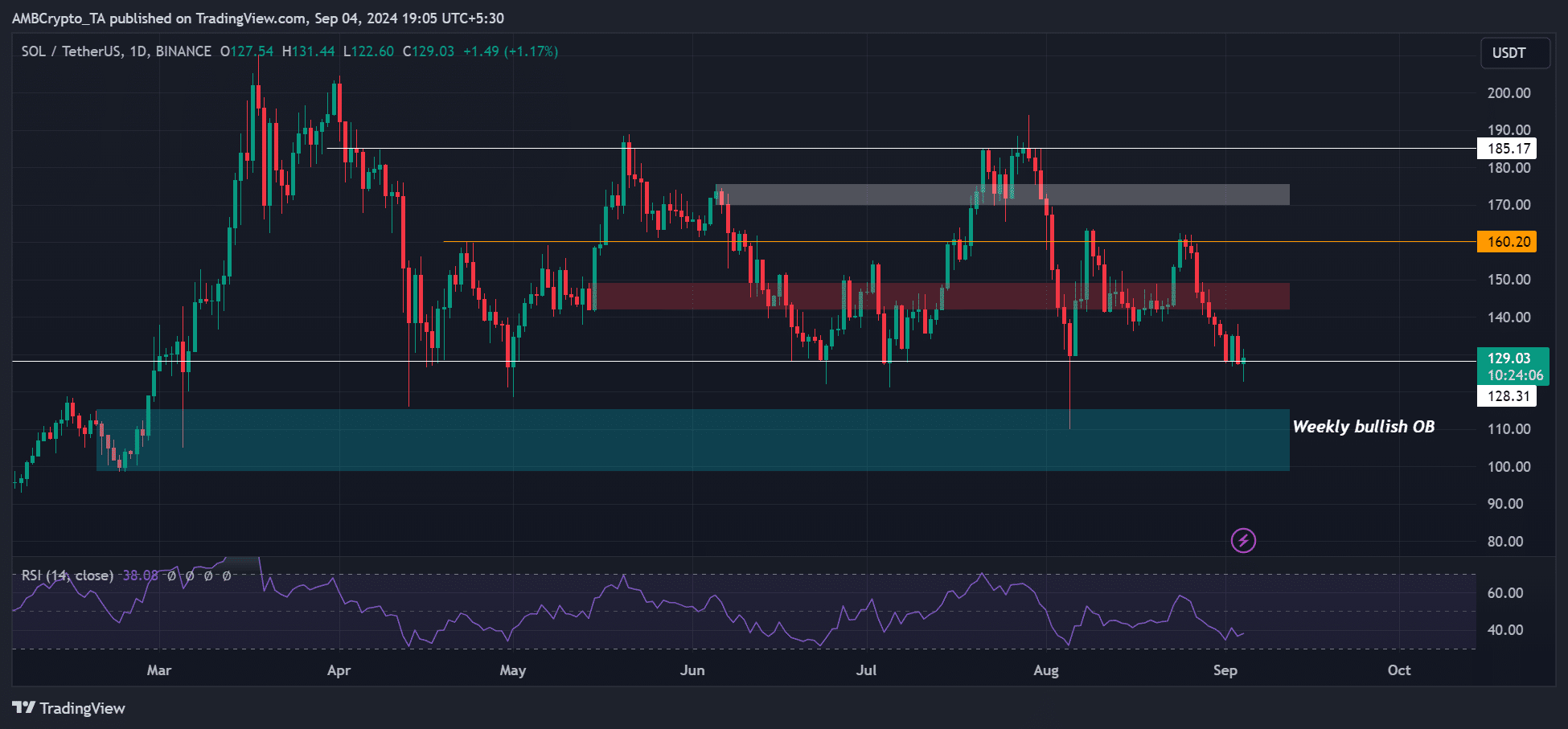

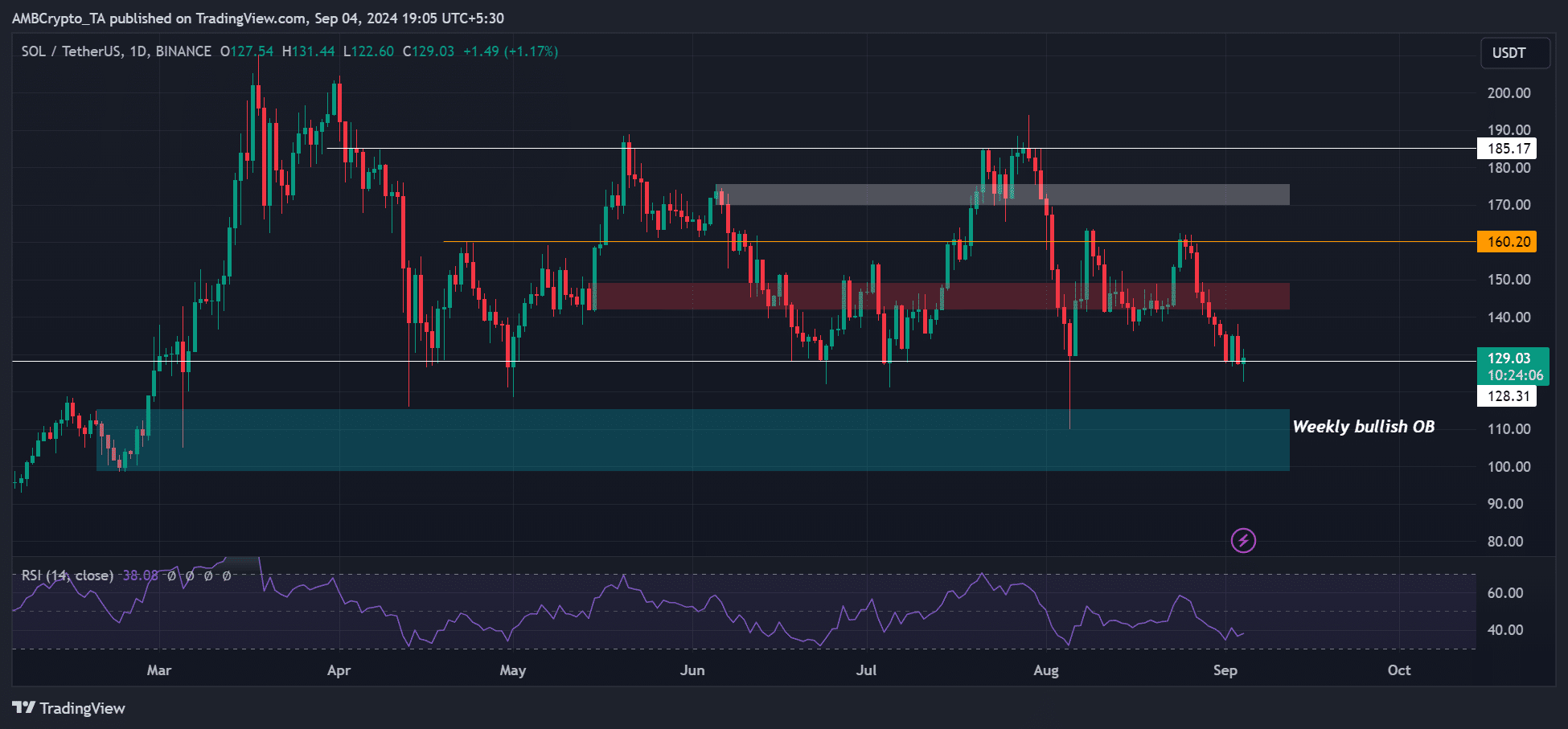

On the price chart, SOL was barely holding on to the $128 support level after a price rejection at $160. A move towards $110 couldn’t be overruled if sellers breached the support.

Source: SOL/USDT, TradingView