- XRP’s volatility earlier this month has given way to stability over the past ten days

- Steady gains were encouraging, but market sentiment could deter XRP bulls

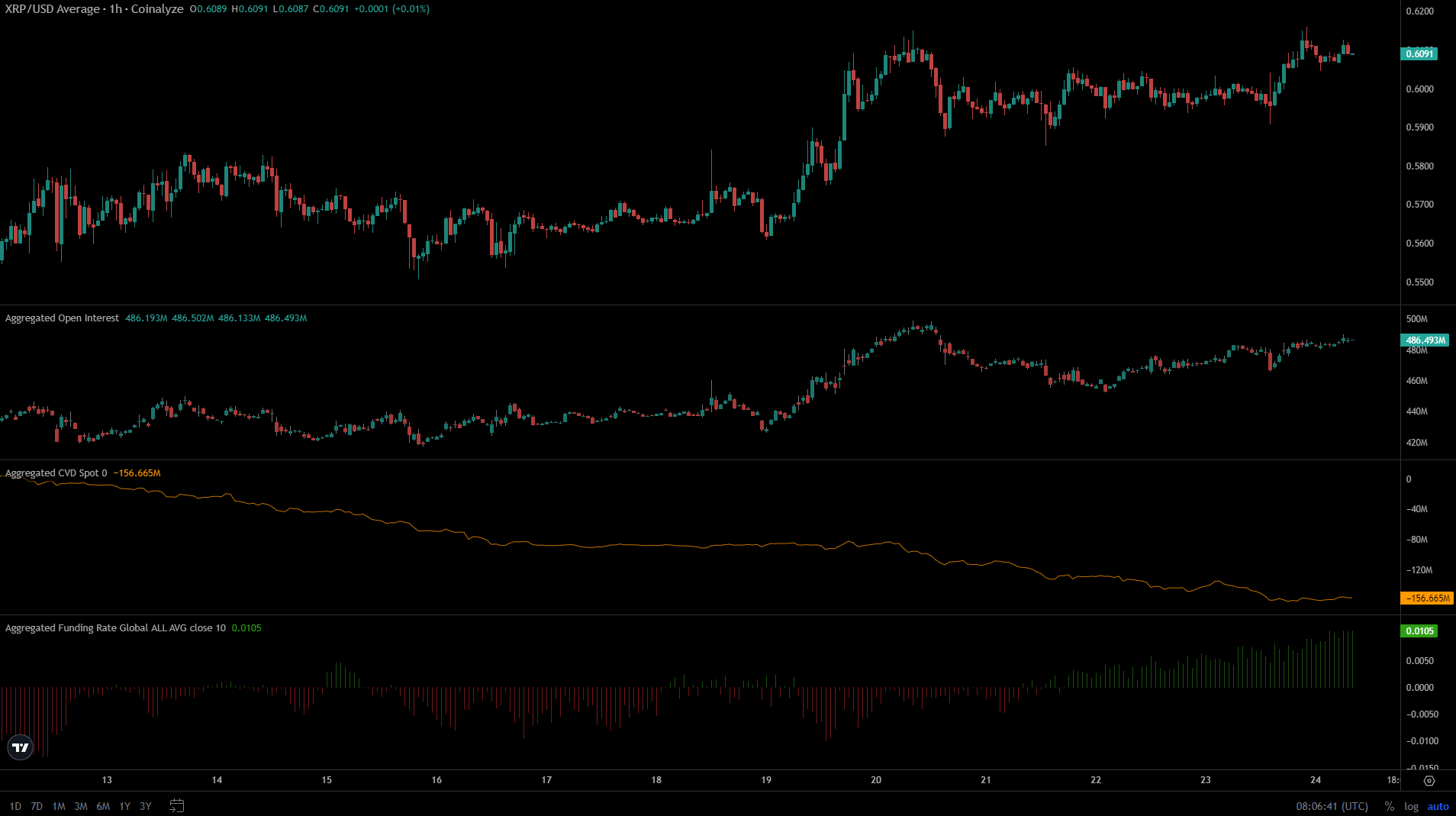

XRP’s price trend has been slow for much of the past ten days, but the $0.585 mid-range resistance has been overcome. What this means is that the highs of the range that XRP has traded within for more than a year would be the next target.

A recent report highlighted how the token presented an attractive buying opportunity. Should traders aim for lofty heights, or exit their trade and secure profits near the range extreme?

The next bullish target is in sight

Source: XRP/USDT on TradingView

Now that the $0.585 mid-range level has been breached, the $0.7 range high is the next clear target. XRP has gained by 9.9% since last Friday, and the daily RSI seemed to be above 50 to denote bullish momentum as a result.

However, the $0.63-zone has served as resistance since early July. Additionally, Bitcoin [BTC] also has a resistance zone at $64k-$66k and was trading at $64.1k at press time.

The OBV was steadily rising to indicate strong demand, but the bulls might find it hard to push prices above $0.63 if the market-wide sentiment turns bearish in the coming days.

In case of rejection from the resistance level, bulls would do well to maintain prices above the $0.585 support. This would encourage swing traders of a buying opportunity targeting the range highs.

Speculative sentiment is keenly bullish

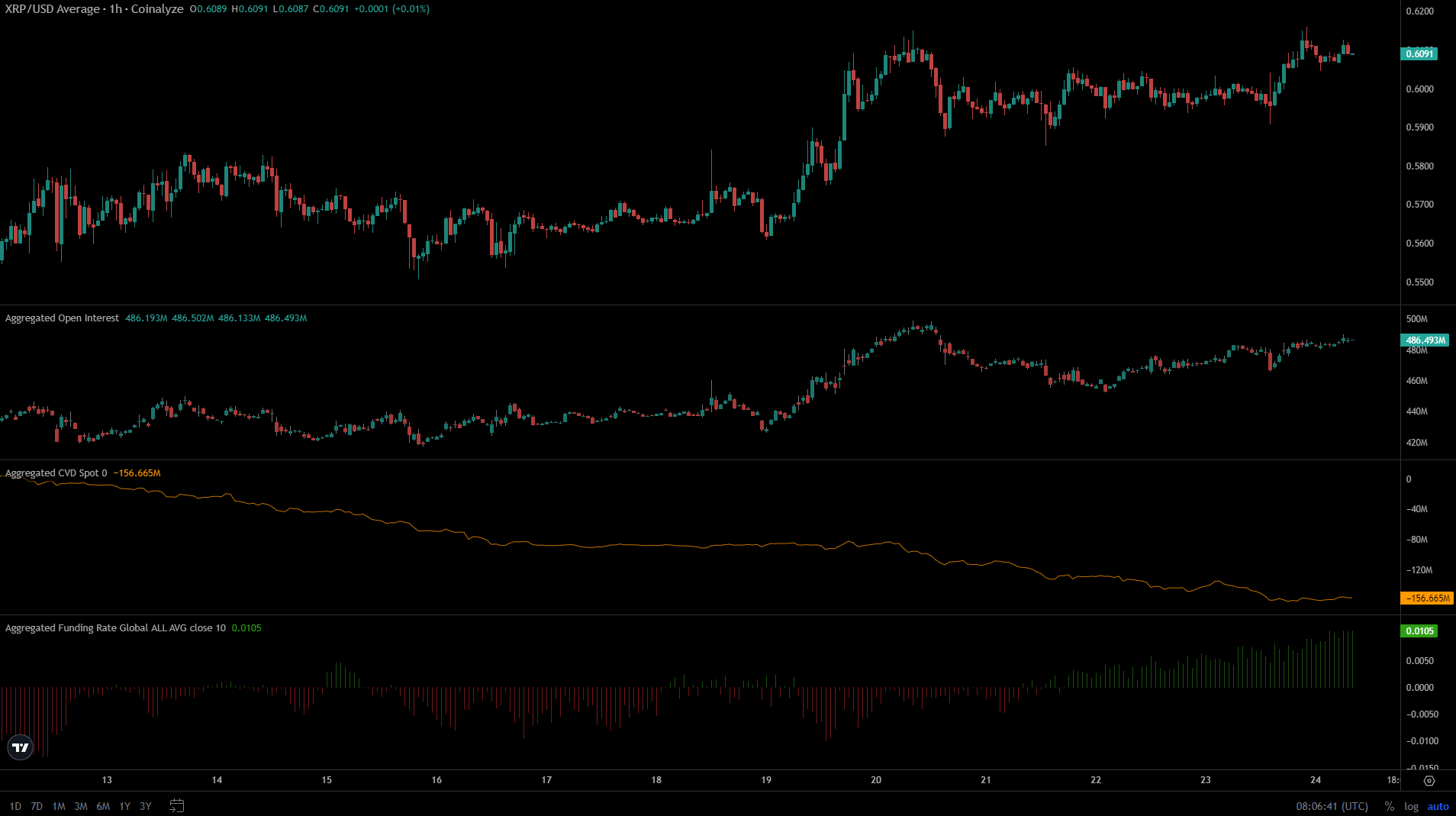

Source: Coinalyze

XRP’s price gains were accompanied by a steady uptick in the Open Interest. Together, they signaled Futures traders willing to go long and outlined bullish sentiment. The funding rate has also been growing more positive.

Read Ripple’s [XRP] Price Prediction 2024-25

Finally, the spot CVD stabilized its downtrend, without moving higher yet. Together, there was evidence for some more gains for XRP, but it is unclear if there is enough strength to propel the price to $0.7.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion