- A popular analyst noted a sell signal for AAVE that could result in an average of 27% price drop.

- On-chain metrics showed that the asset is overvalued.

Aave [AAVE] saw a high volume of buying from whales recently. Lookonchain pointed out that whales have been buying AAVE worth millions of dollars since the 20th of August.

One whale, in particular, has bought AAVE worth $10.4 million in under a day.

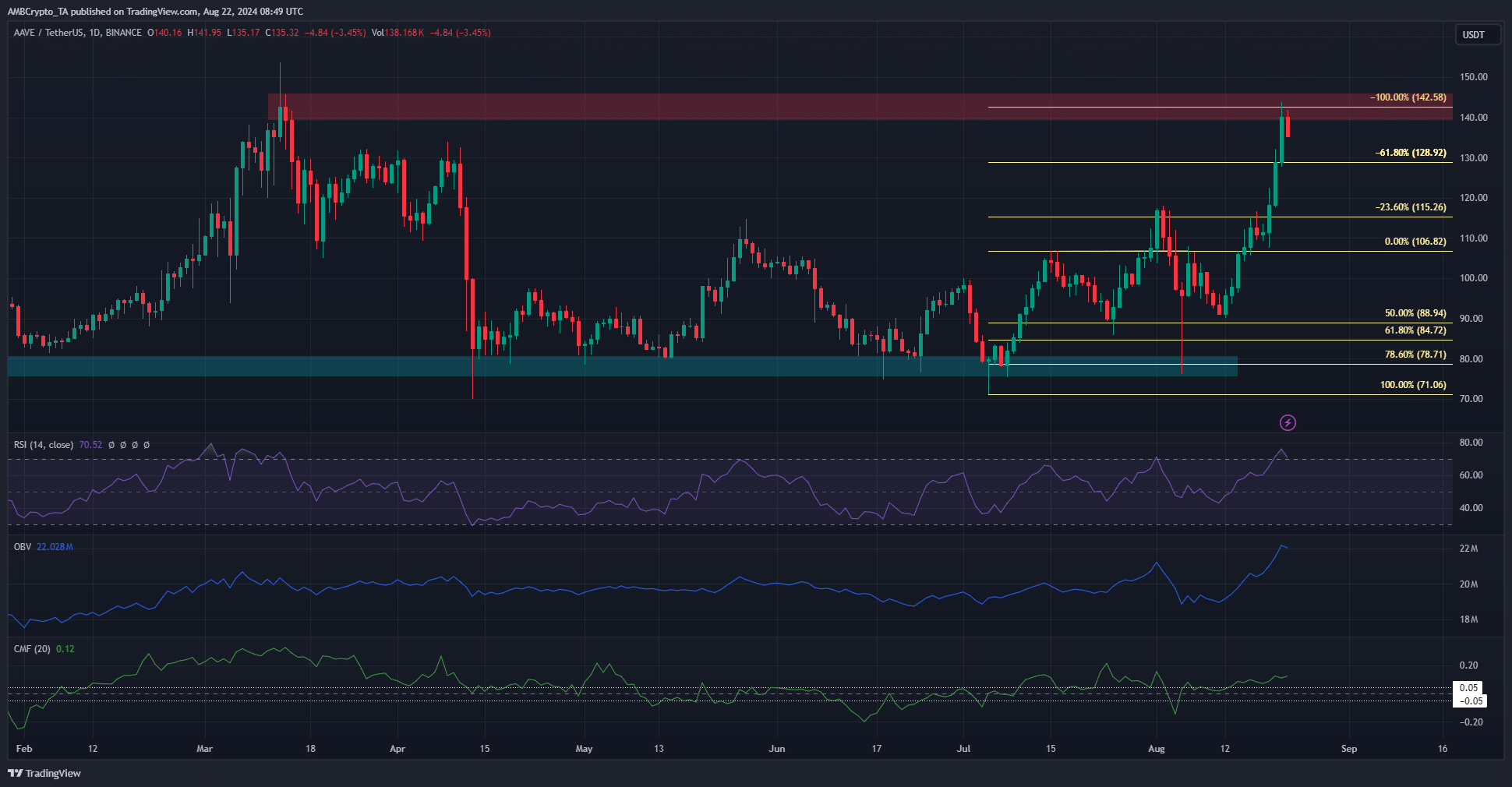

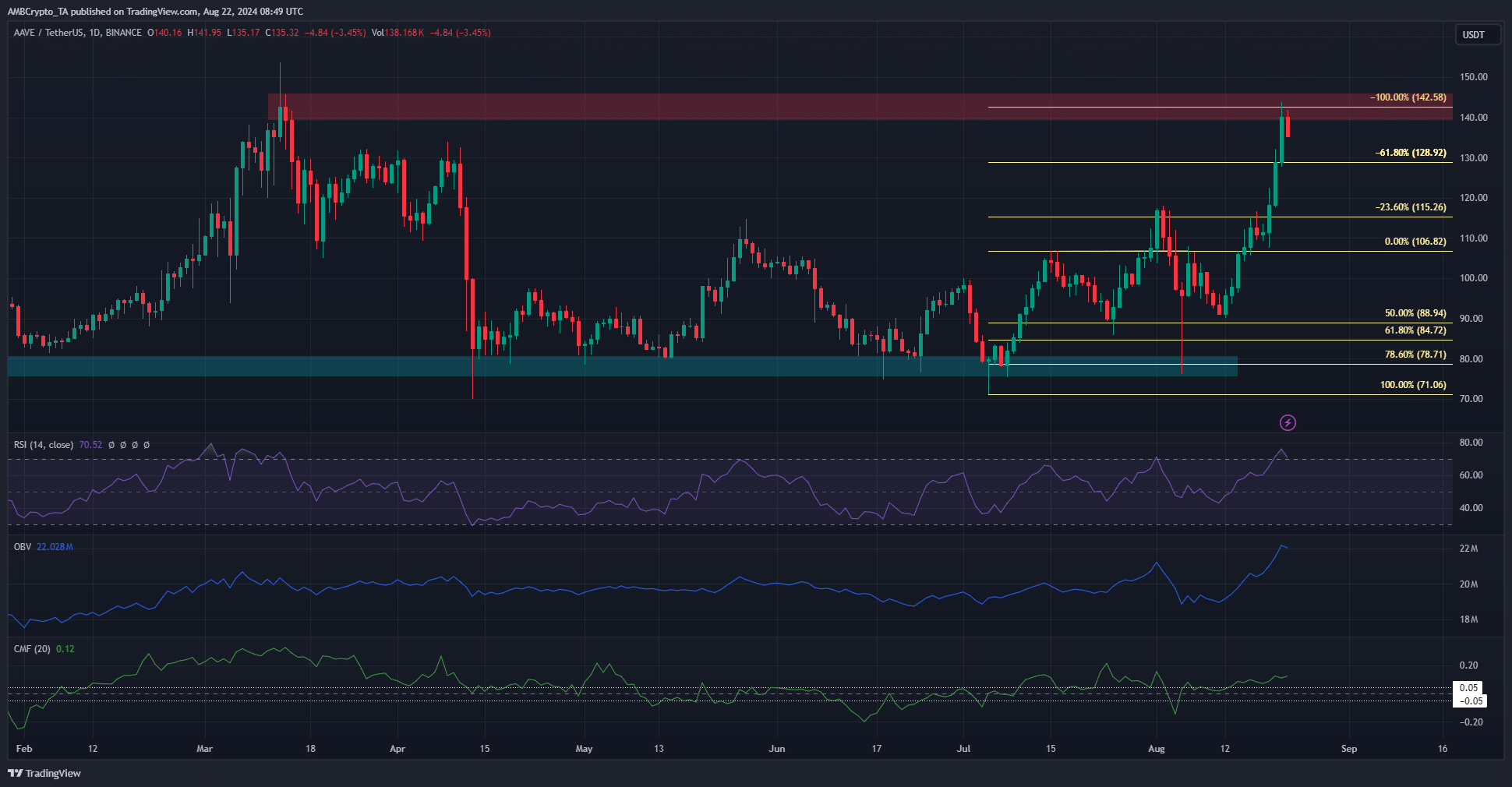

This accumulation trend among addresses was a positive sign for AAVE. Yet, the price saw a rejection from the $140 resistance zone that marked the local top back in March.

A deep retracement is likely

Source: Ali on X

Crypto analyst Ali Martinez posted on X (formerly Twitter) that the TD Sequential flashed a sell signal on the AAVE daily chart. This has seen a 27% drop on average.

If such a correction plays out, Aave would drop to the $100 mark.

Source: AAVE/USDT on TradingView

The daily timeframe showed a strong bullish structure and momentum. The OBV also made a new high to indicate significant buy volume behind the rally.

However, despite all the positive signs, AAVE crypto still stopped at the $140 resistance zone that marked the March highs.

Based on the July rally, a set of Fibonacci levels had been plotted. They showed that $142.58 was also the 100% extension of that move, reinforcing the strength of the resistance here.

AAVE’s mixed signals, explained

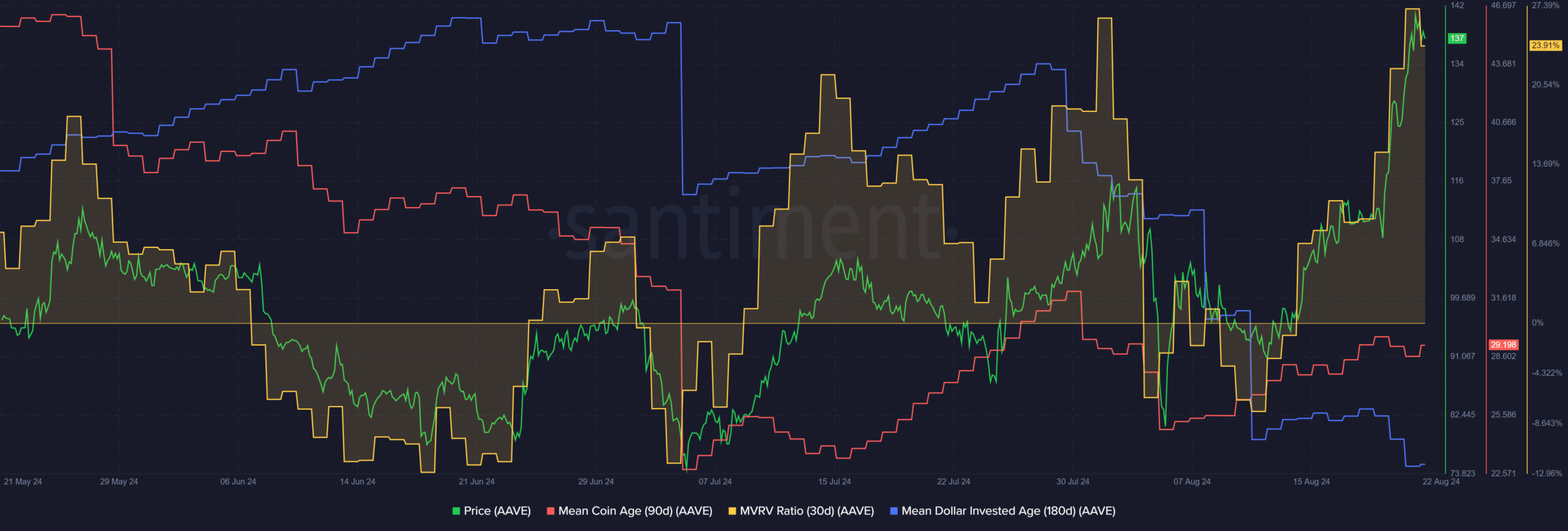

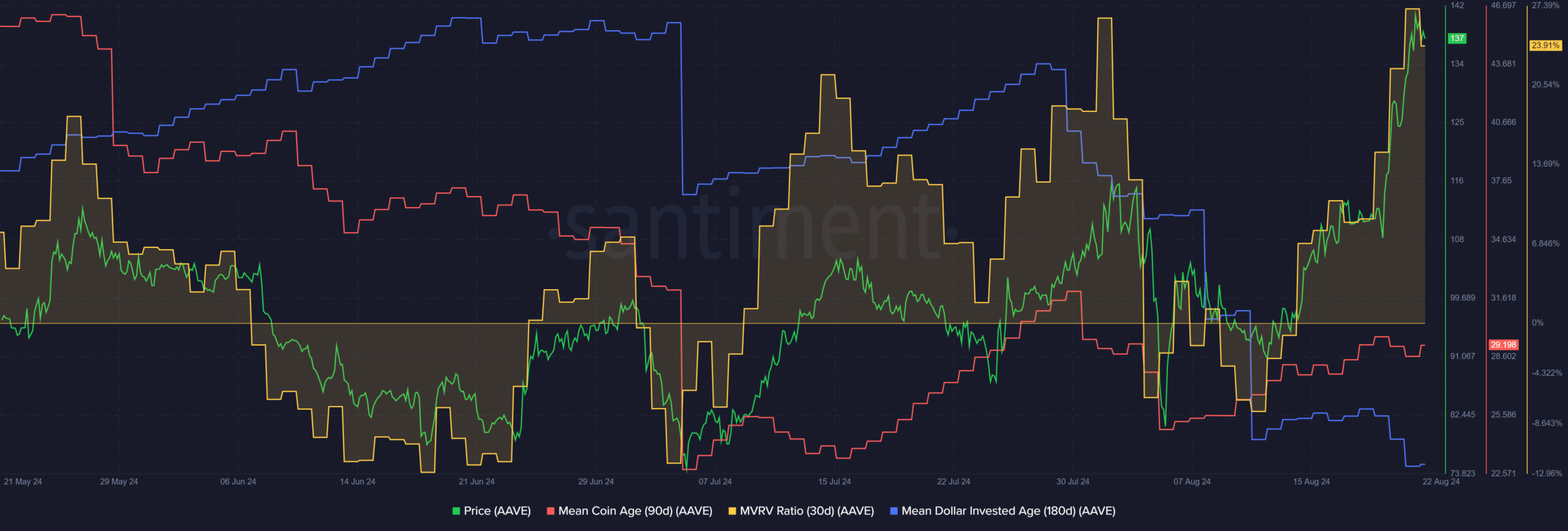

Source: Santiment

The 30-day MVRV was the highest it has been since early March. Short-term holders were at a profit, which could lead to selling pressure. The mean coin age has lacked a consistent trend over the past month.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

On the other hand, the falling mean dollar invested age was a huge positive. It signals increased token circulation and new investments and is a bullish signal.

Therefore, a retracement toward $105-$115 followed by a rally appeared likely for Aave.