- Litecoin can breakout if altcoin season kicks in and institutional buyers add to their bags.

- Litecoin’s hashrate soared to new historic highs, but will short-term price enjoy some bullish relief?

Litecoin [LTC] may not have ETFs yet like its bigger siblings, but that has not stood in the way of institutional demand.

Grayscale, one of the most noteworthy institutional investors in the crypto space, has been adding more LTC to its portfolio.

Recent data reveals that Grayscale has been accumulating Litecoin regardless of market headwinds. The institutional investors did not slash its holdings during the crash at the start of August.

Instead, it maintained a positive balance, which grew from 1.75 million LTC to 1.85 million LTC in the last four weeks. This is the highest amount of Litecoin that Grayscale has ever held.

Grayscale’s Litecoin bags represent 0.024% of LTC’s current supply. While this may not be much, it highlighted an important observation that whales and institutional investors were still interested in it.

Just a month ago, the Litecoin network confirmed that Fidelity, an investment firm with over $12 trillion assets under management, started offering LTC exposure to its clients.

These developments may attract more interest from retail traders.

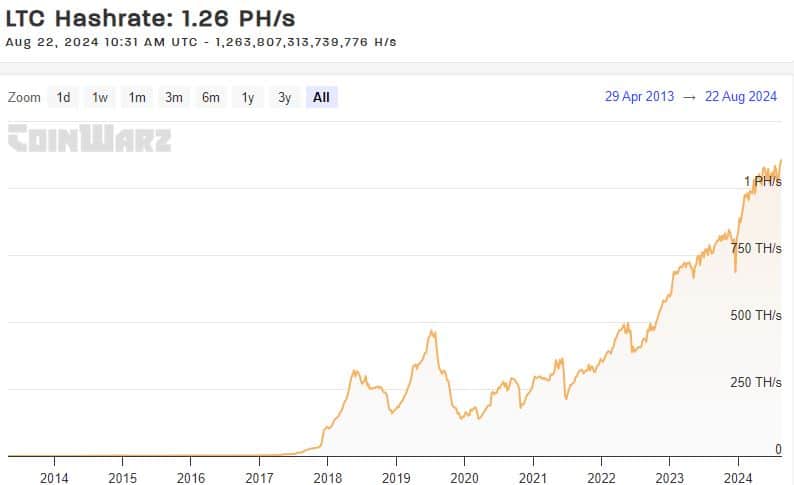

Litecoin hashrate soars to new ATH

Litecoin has also been growing in other key areas. The most notable one being its hashrate, which has been steadily gaining over the years. The hashrate peaked at a new all-time high of 1.29 PH/S within the last 24 hours.

Source: Coinwarz

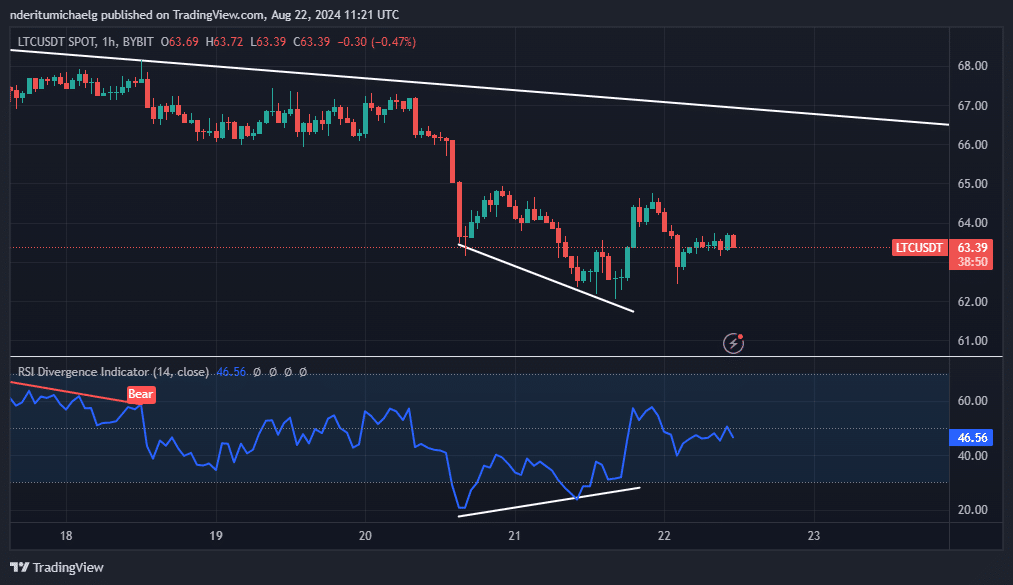

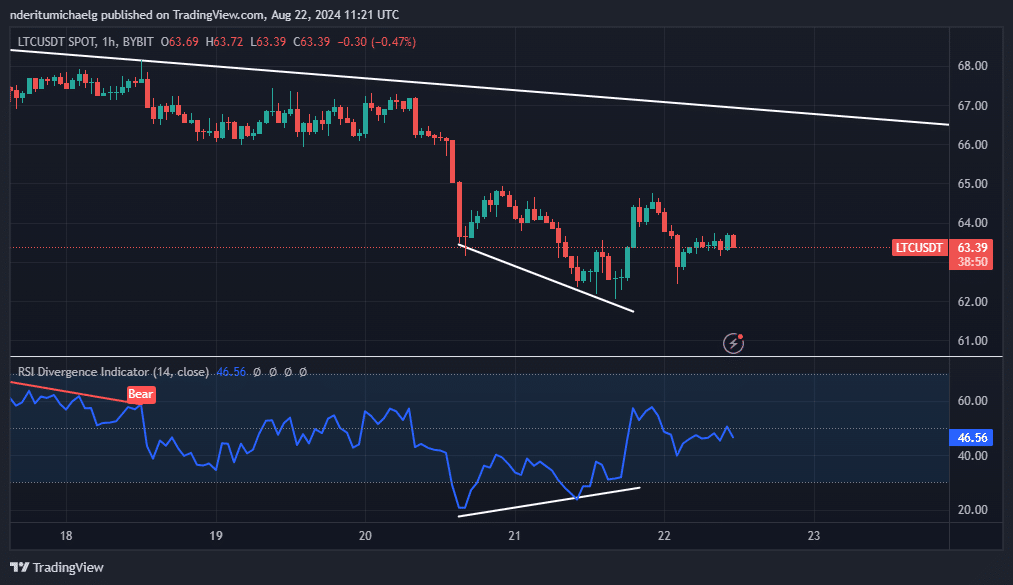

Litecoin has been bearish for the last five days after pulling back from a descending long term resistance. However, it might be preparing for a bullish relief.

Its 1-hour chart recently formed a bullish divergence pattern with the RSI.

Source: TradingView

The bullish divergence suggested that LTC might pivot to the upside. An outcome that could possibly bring about another retest of the descending towards the $66 price range.

It traded at $63.32 at press time, which was close to a previously tested support level.

Zooming out, especially on the 1-day chart, revealed a high probability of a breakout. This is because Litecoin is in a wedge pattern and the support and resistance were squeezing it into a breakout or breakdown zone.

Is your portfolio green? Check out the LTC Profit Calculator

The odds may turn out in favor of a bullish outcome now that institutional demand is actively engaged in accumulation. However, these observations do not necessarily guarantee that outcome.

The markets have recently demonstrated a lot of unpredictability and the markets are currently on the edge regarding the state of the global economy. These factors may influence liquidity flows in the next few months.