The number of businesses hiring international employees is on the rise: spurred by rising domestic labor costs and the need for specific talent, 75% of small-to-medium sized businesses in a 2023 survey of 500 owners and decision-makers by Gusto said they planned to increase international headcount, and 54% planned to do so in the coming 1-3 years.

But for businesses looking to take advantage of the global talent pool, ensuring they are set up to pay their international employees and contractors in a timely fashion can be a bear. Enter Thera, a payroll and payments startup founded in 2022 that promises to help businesses of all sizes navigate the maze of differing countries’ labor rules and regulations and get employees paid no matter where they work from.

“We started with this thesis that more businesses are going to be global from day one,” said Akhil Reddy, Thera’s founder and CEO, in a phone interview with VentureBeat earlier this week.

The thesis has legs. Today, Thera announced it has raised $4 million in seed funding from Y Combinator, 10x Founders, Amino Capital, Zillionize, and Bayhouse Capital, as well as angel investors Oliver Jung, Chris Bakke, Andrew Yeung, Akash Magoon, and Bobby Matson.

Thera’s origin story

Reddy has considerable experience designing systems to ease the flow of payments digitally, having previously built systems for Amazon Prime, the e-commerce giant’s free-shipping and included media subscription service tier.

“Two of the big things I learned at Amazon were the importance of selection and transferring affordable credits,” Reddy told VentureBeat. “We’re taking that same ethos and trying to apply it to SaaS [software-as-a-service.]”

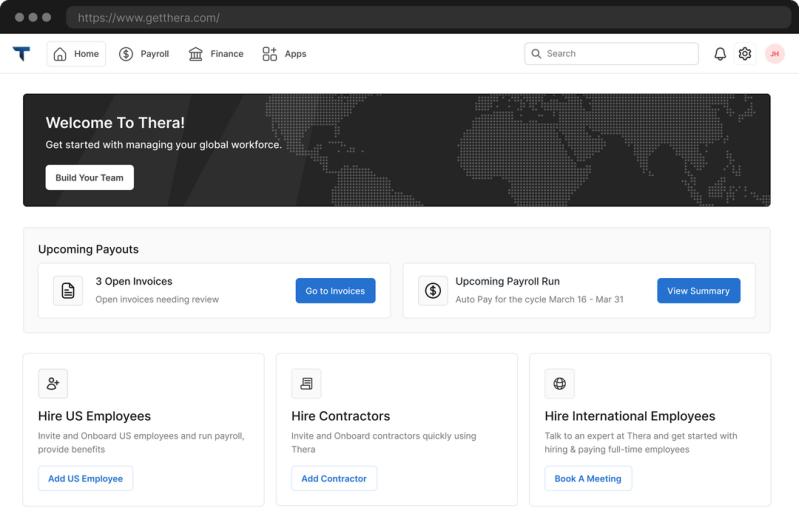

Inspired by that experience, Thera’s new, built-from-scratch system replaces multiple financial tools, offering an ecosystem of native apps for payroll, treasury, and accounts payable/receivable (AP/AR) services.

“Payments are a massive challenge for many companies,” Reddy added in a press release provided to VentureBeat. “Through our unique bundled app model and customer-centric approach, we strive to create a streamlined experience to manage all financial operations while increasing our customer’s bottom line. We are committed to providing the rates and transparency the industry so desperately needs.”

What Thera offers

Thera offers a range of services including US Payroll for hiring and paying employees in all 50 states, Contractor Management for over 150 countries, multiple currencies, and Employer-of-Record services in 150+ countries, and payments in 5 methods. It also features Thera AP/AR for global invoicing and payments, and Bill Pay to manage all payables in one place.

Thanks to its integration with major payments providers and global systems, as well as a database of consistently updated information on the different labor laws around the world, combined with its platform of native apps for payroll and tracking, Theta expects to save its customers significant sums of money.

On its website, the company boasts of being 80% more affordable than Deel AP/AR for global payroll and 90% more affordable than Stripe Invoicing. Also, it claims a speed improvement over rivals that benefits employees and contracts, with 95% of payrolls arriving same day compared to 2-10 days for other payroll companies.

By saving on these costs and time, Thera also says it can pass the savings onto contractors — who can make up to 3% more than other providers.

Thera’s business customers can also expect to receive several direct support and success reps available to them 24/7/365 through Slac.

“You get a customer success manager, and you also get a global HR specialist in a Slack channel,” Reddy told VentureBeat. “Everyone gets a shared Slack channel to answer any questions they might have.”

Thera’s initial success

By consolidating these services, Thera provides businesses with a seamless experience and some of the most competitive rates on the market.

Already, Thera is processing $10M+ in payroll annually for thousands of workers worldwide at some of the fastest-growing companies in the U.S., including Oceans, Landed, 1840 & Company, and Zendrop.

“We saw a lot of customers complaining about the lack of transparency with their existing [payments] providers,” he elaborated to VentureBeat. “There’s so many hidden fees in the FX [financial experience], and then also one-time fees that they were unaware of.

Where Thera goes next

The $4 million Seed funding will be instrumental in accelerating Thera’s growth.

The company plans to use the funds to further develop its platform and expand its team in New York City, where it is currently headquartered.

Reddy also told VentureBeat that while Thera’s financial and payments apps for businesses are today available on desktop via the web, the company is working on mobile offerings that should be available soon.

As Thera continues to grow, the company remains focused on its mission to streamline financial operations for businesses around the world.

With the new funding, Thera is well-positioned to enhance its platform, expand its team, and solidify its position as a leading player in the B2B payments space.

Source link