- AAVE’s number of active addresses doubled in the past three months.

- AAVE’s price action was bullish, but indicators hinted at a possible trend reversal.

Aave [AAVE] has showcased promising performance in terms of network activity over the last few weeks. This indicated a rise in its adoption and usage. Apart from that, the token’s price also witnessed a similar rise. Let’s have a look at what’s going on.

Aave’s rising network activity

IntoTheBlock recently posted a tweet highlighting a notable development related to AAVE. As per the tweet, on-chain activity on the blockchain has surged this month, with the number of active addresses doubling compared to three months ago.

AMBCrypto then took a closer look at the blockchain’s network activity. Our analysis revealed that the blockchain’s daily active addresses also increased last week.

To be precise, the number increased by more than 140% in the past seven days. Thanks to that, AAVE’s daily transactions also followed a similar increasing trend during the same time.

Source: IntoTheBlock

However, when AMBCrypto checked Token Terminal’s data, it was revealed that the blockchain didn’t perform well in terms of captured value.

It was surprising to note that despite the rise in network activity, the blockchain’s fees declined over the last 30 days. This also resulted in a slight decline in its revenue.

Source: Token Terminal

AAVE bulls have arrived

While all this happened, AAVE bulls took control of the market by pushing the token’s price up.

According to CoinMarketCap, the token’s price increased by more than 4% in the last 24 hours. At the time of writing, the token was trading at $133.01 with a market capitalization of over $1.98 billion.

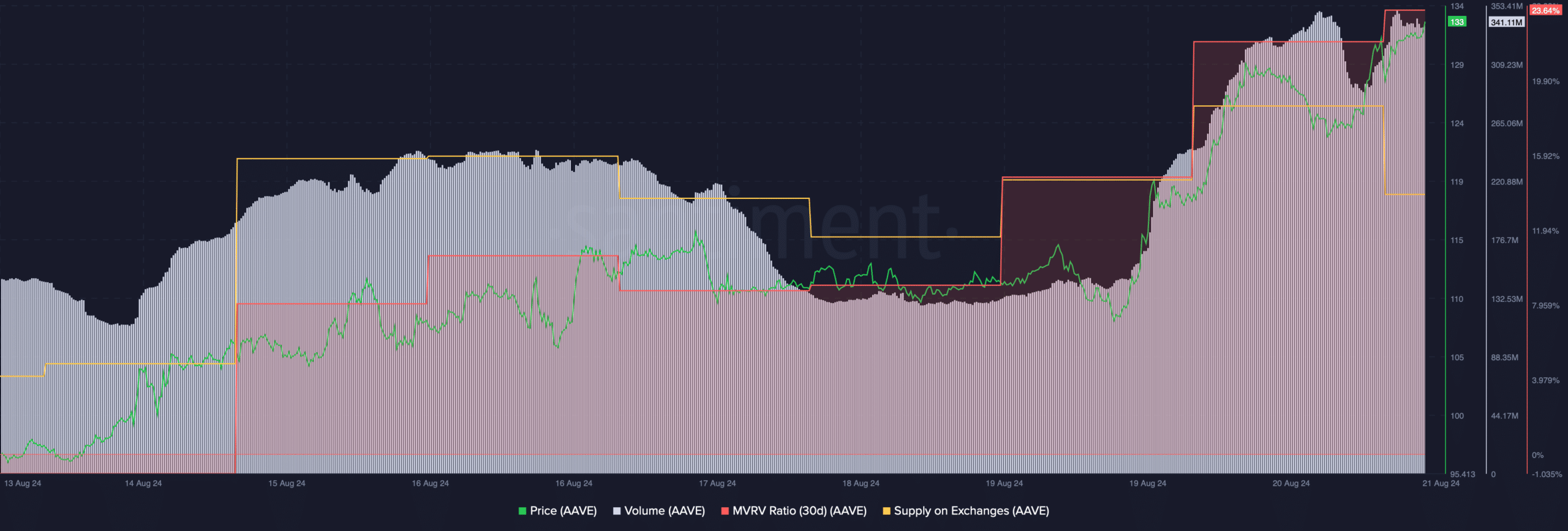

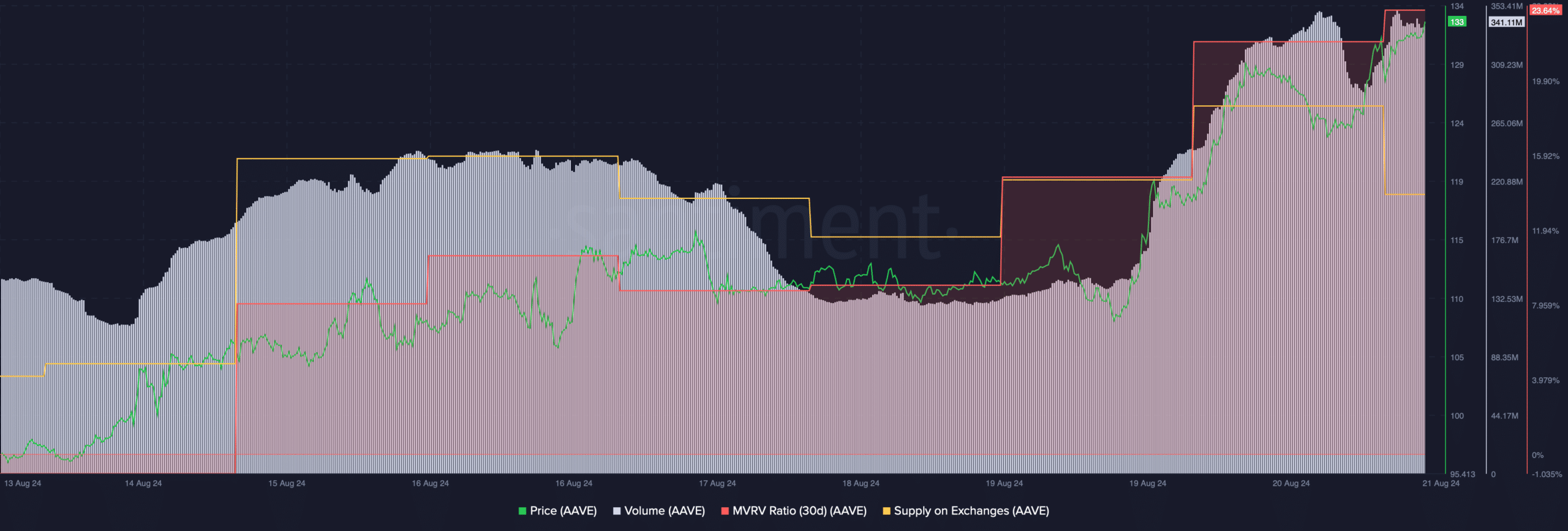

Our analysis of Santiment’s data revealed that the token’s volume increased along with its price, which acted as a foundation for the bull rally.

AAVE’s MVRV ratio also increased,hinting at a further price rise. However, selling pressure on the token surged last week as its supply on exchanges went up. Generally a rise in selling pressure results in price corrections.

Source: Santiment

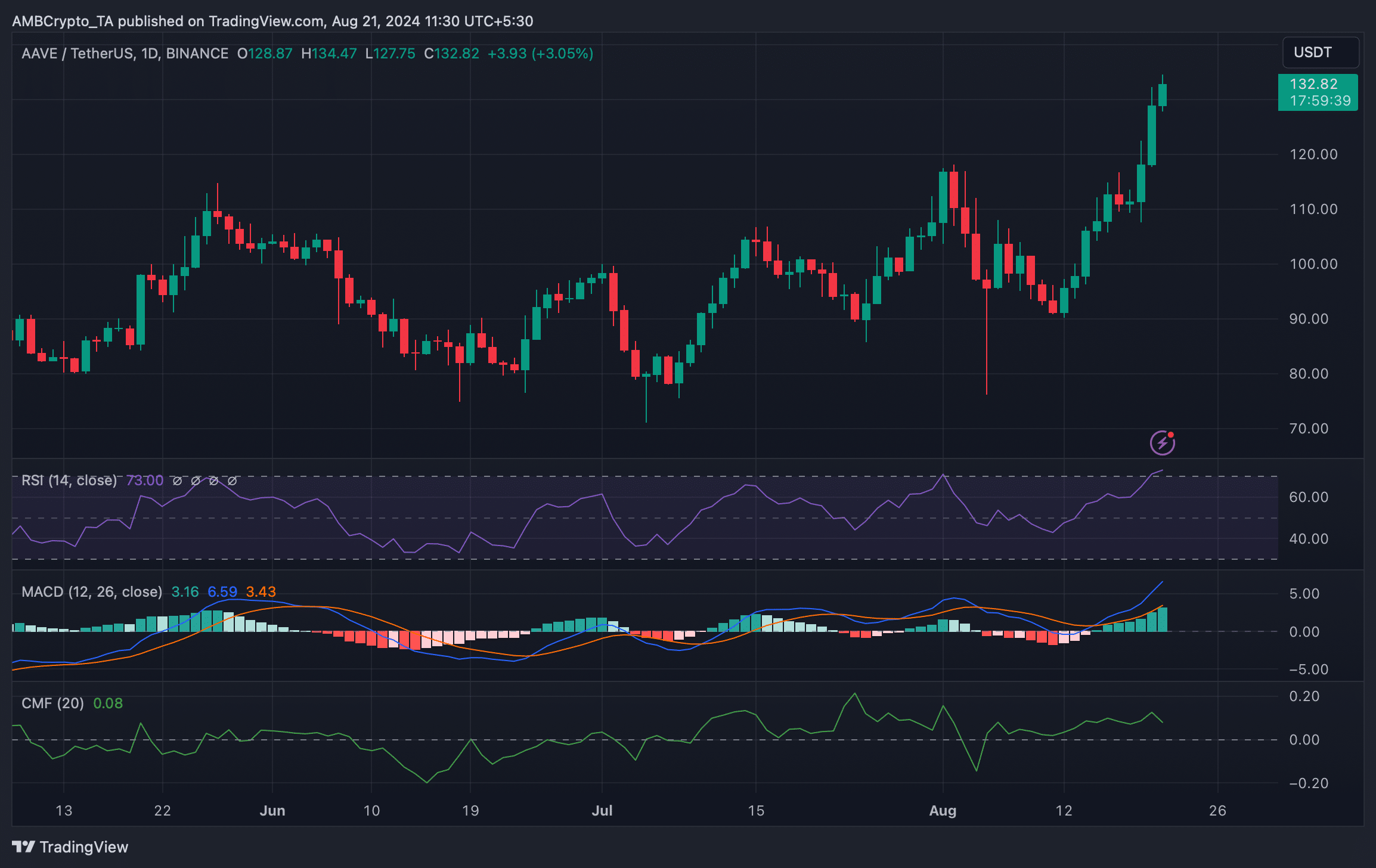

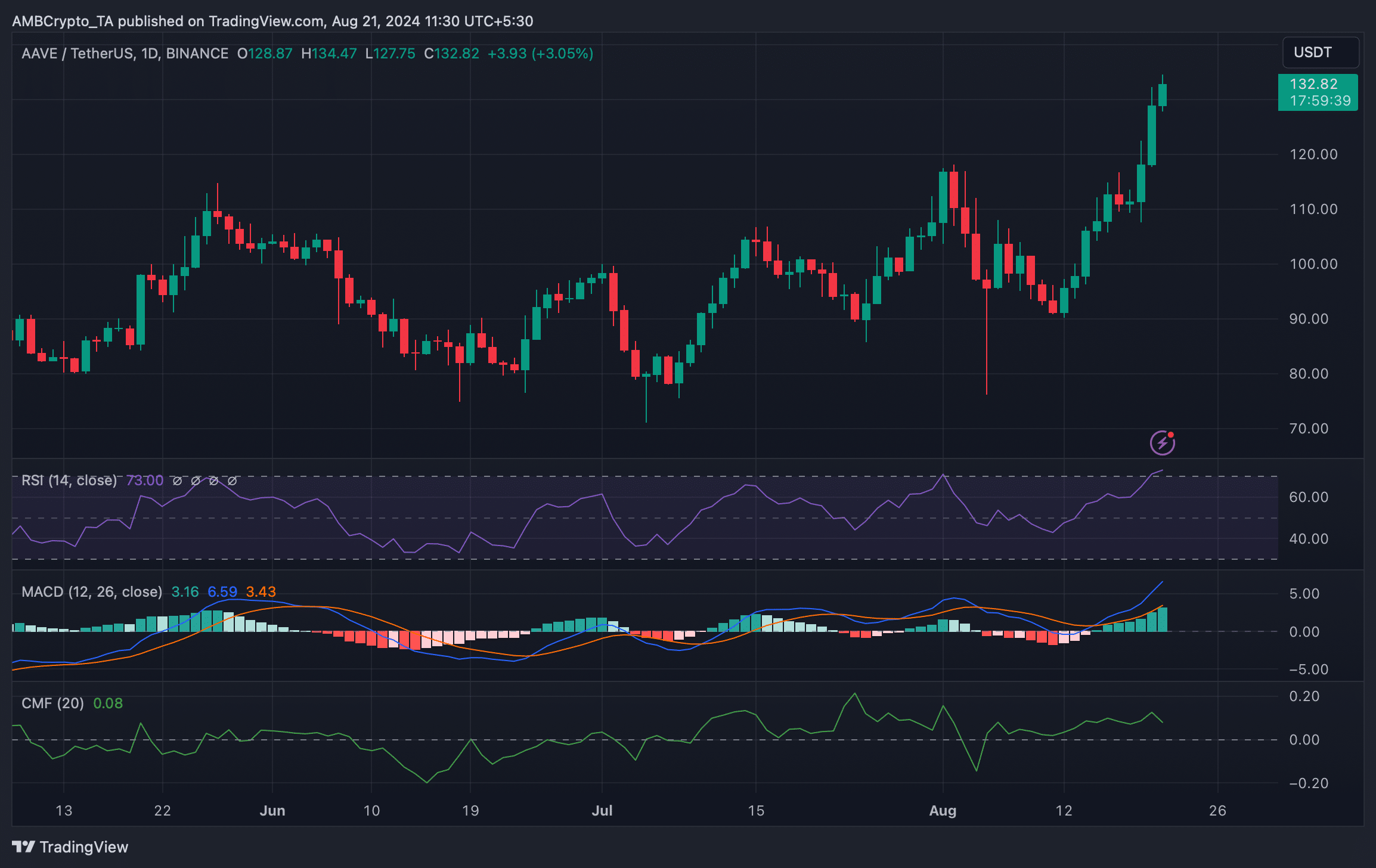

We then checked the token’s daily chart to find whether the uptrend would continue. The technical indicator MACD displayed a bullish crossover.

But the Relative Strength Index (RSI) entered the overbought one, which might increase selling pressure. Additionally, the Chaikin Money Flow (CMF) also registered a downtick, suggesting that AAVE’s bull rally might end soon.

Source: TradingView

Realistic or not, here’s AAVE’s market cap in BTC’s terms

AMBCrypto’s analysis of Hyblock Capital’s data revealed that if the bull rally comes to an end, then investors might witness AAVE plummeting to $101 in the coming weeks.

However, if the bulls manage to maintain their lead, then the token might soon touch $140.

Source: Hyblock Capital