- AAVE among top performers, with positive patterns.

- Stablecoin market cap and whale activity on the rise.

In the last 24 hours, top performers were older coins and large caps, a positive sign for the crypto market as it moves beyond its recent range-bound and bearish phase.

It’s preferable for Bitcoin and large-cap cryptos to lead, maintaining liquidity rather than random meme-coins.

Aave [AAVE] gained 4% and ranked fourth as Daan Crypto noted on X. AAVE is expected to continue rising as crypto markets recover from the Japan stocks crash.

Source: Daan Crypto/X

First, AAVE is showing strong potential on higher time frames. Recently, AAVE has been a top performer and could surpass $260 price if it breaks the $153 level.

After breaking out from a falling wedge pattern, AAVE made a new short-term high, retested the breakout zone, and respected the fair-value gap, stalled and now its surging.

Currently trading at $129, with a bullish weekly candle, AAVE is expected to surge higher if momentum continues.

Source: TradingView

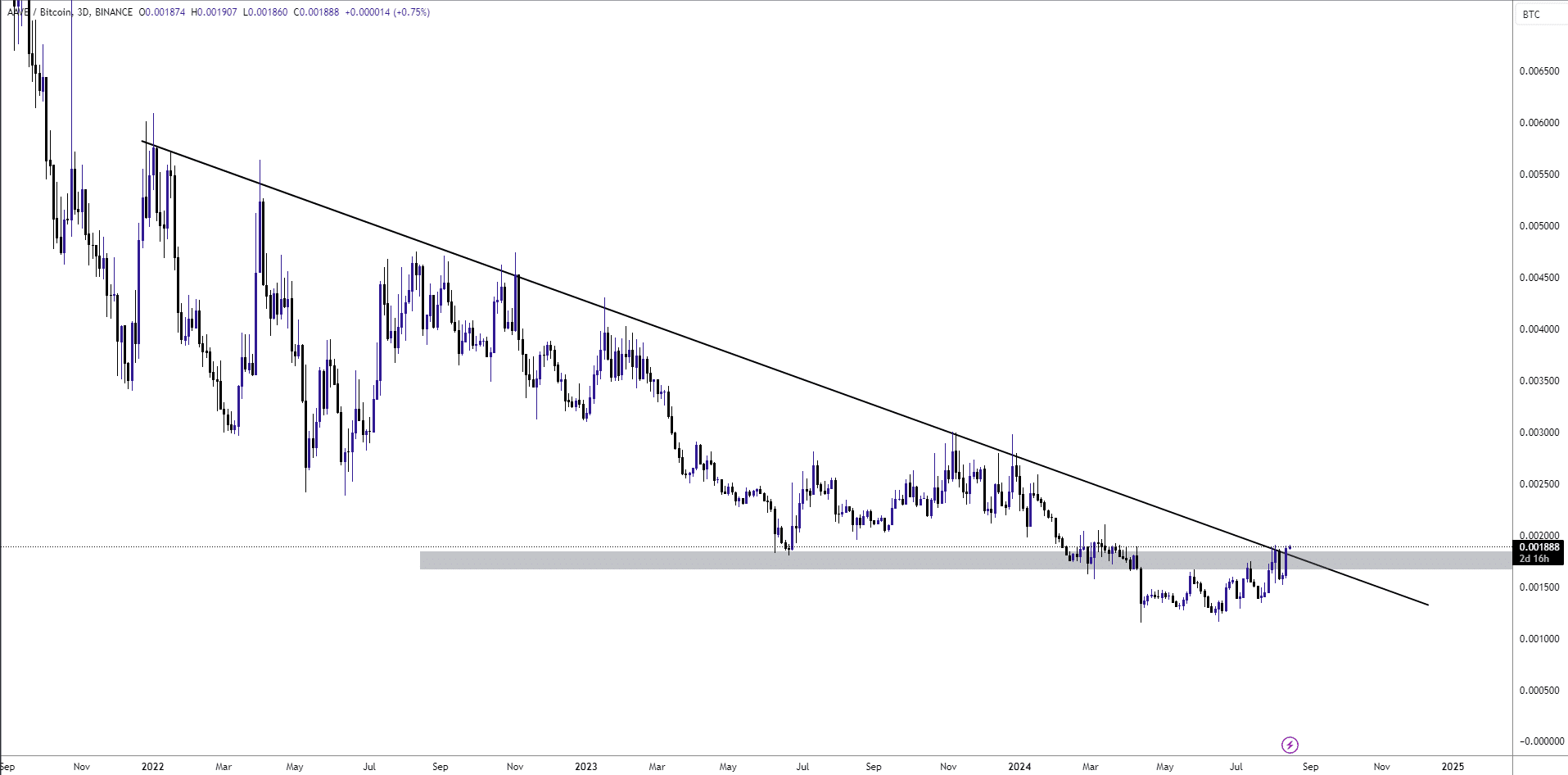

AAVE/BTC breaks out as stablecoin market cap grows

The continued strength of AAVE is supported as it remained in an accumulation phase within a 900-day range but rejected the $113 key resistance four times before breaking.

Meanwhile, the AAVE/BTC pair has broken out of a 3.5-year downtrend and flipped bullish.

With AAVE’s price expected to hit and surpass $153, there’s potential for a move towards the next liquidity level at $260.

Source: TradingView

Spot trading will be crucial as traders and investors scale up during breakouts or pullbacks.

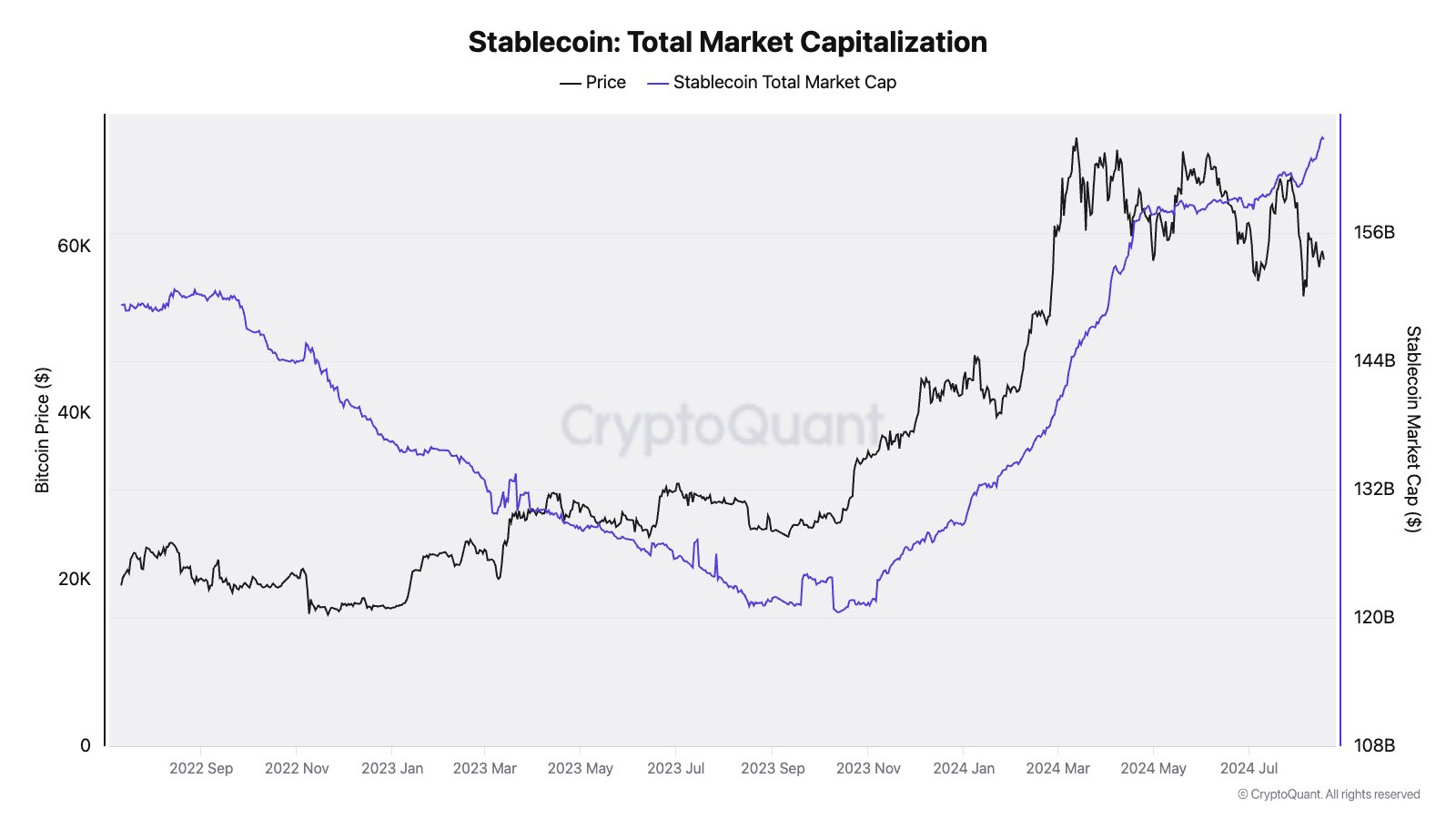

Many are focusing on global M2 increase, overlooking the stablecoin market capitalization which has hit a new high above $165B,

This increase suggests higher liquidity in the crypto market, which is essential for supporting AAVE’s expected upward trend.

Source: CryptoQuant

The rising total market cap for altcoins indicates that more money is flowing into the crypto markets, further boosting overall market momentum.

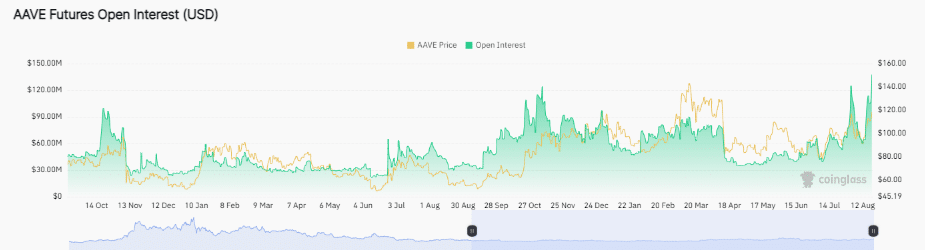

Increase in wallet activity and open interest

AAVE is seeing increased adoption as wallet activity and open interest rise. Today as at press time, open interest hit $137.62 million, the highest since June 2022.

Wallet activities also surged, with one smart trader swapping 675.5 $WETH ($1.79M) for 14,777 $AAVE at $121.2, according to SpotOnChain on X. Notably, this was the trader’s first time purchasing $AAVE.

Source: Coinglass

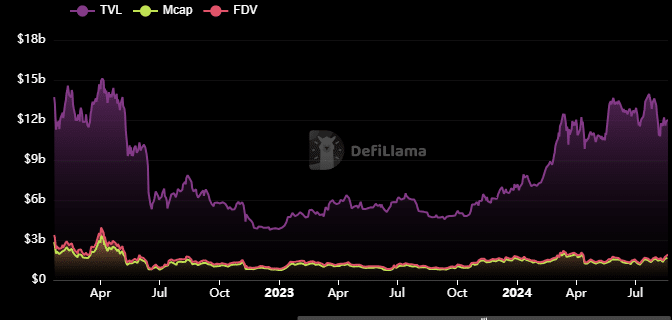

Realistic or not, here’s AAVE’s market cap in BTC’s terms

AAVE’s market cap is about $1.9 billion, with a trading volume of $321 million and a total value locked at $11.5 billion.

The fully diluted market cap stands at $2 billion, with a circulating supply of 14.9 million out of a total 16 million. A 12.57% volume-to-market cap ratio indicates high liquidity for AAVE.

Source: DefiLlama