- A major Ethereum whale deposited $154M worth of ETH to exchanges, sparking speculation of a potential sell-off.

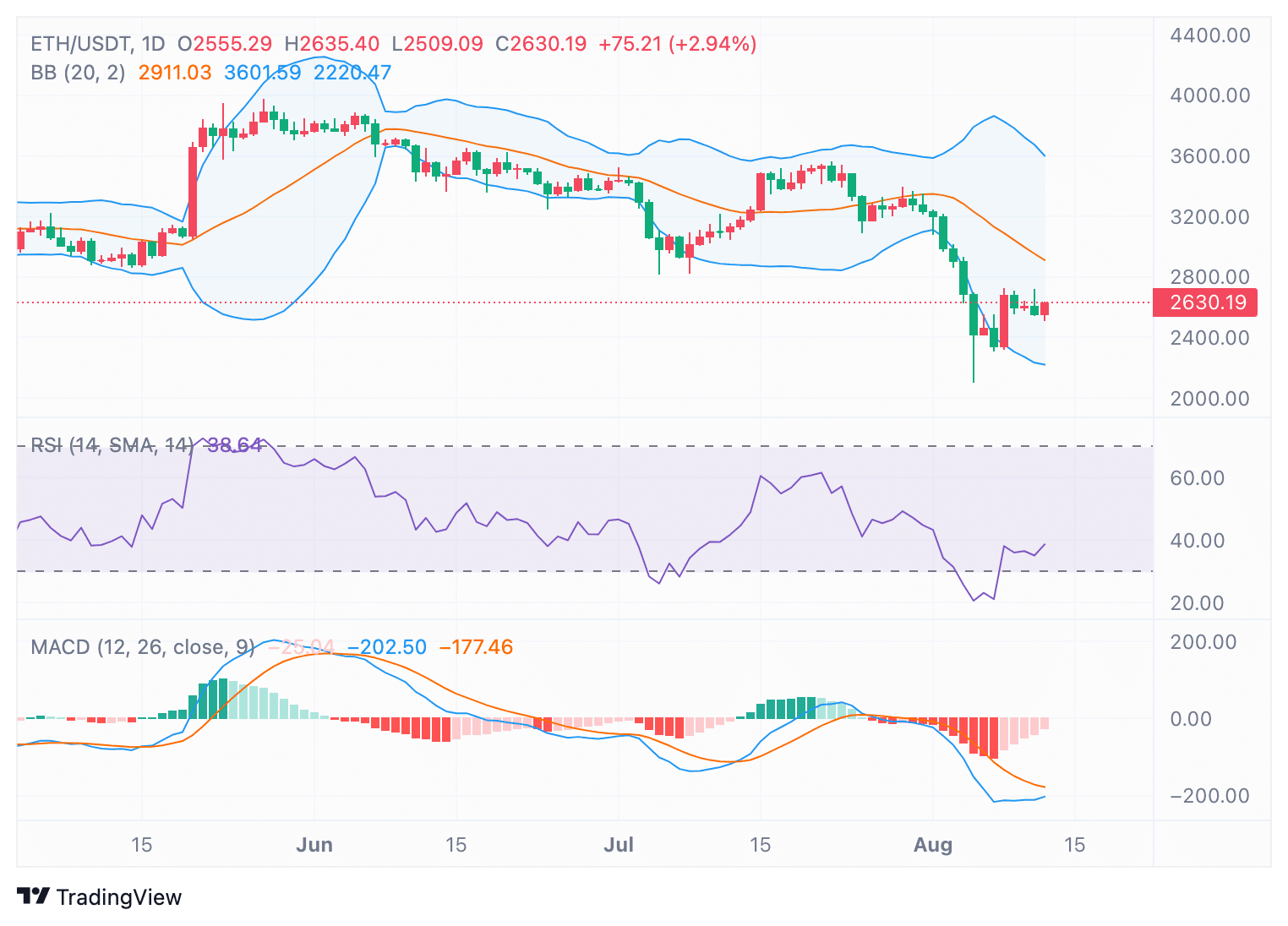

- Ethereum’s RSI hinted at recovering from oversold levels, while the MACD suggested a possible bullish turnaround.

Ethereum [ETH] has recently experienced increased market activity, with notable transactions suggesting possible market movements.

Among these, a whale, who initially acquired 1 million ETH during the Ethereum ICO at a price of $0.31, has drawn attention.

According to Lookonchain, the whale deposited 5,000 ETH, valued at approximately $13.2 million, to the OKX exchange on the 12th of August.

This transaction followed a series of large deposits over the past month, totaling 48,500 ETH, worth around $154 million, at an average price of $3,176.

The whale’s continuous transfer of large amounts of ETH to exchanges has sparked discussions about a potential sell-off.

Historically, such movements are closely watched as they may signal a forthcoming shift in market dynamics.

Moreover, another whale transaction was reported by Whale Alert, where 12,682 ETH, equivalent to approximately $32.3 million, was moved from an unknown wallet to Coinbase.

This movement added to the speculation that large holders may be preparing to offload their assets, especially in a market environment that has seen volatility in recent days.

Current market conditions

Ethereum’s price has been volatile, trading at $2,598.65 at press time, reflecting a 3.32% decline in the last 24 hours but an 11.74% increase over the past week.

The price trend aligned with technical indicators, suggesting a mixed outlook.

The Relative Strength Index (RSI) was 38.64 at press time, indicating that ETH is recovering from an oversold position but remained below the neutral threshold of 50.

This suggested lingering bearish momentum, although it appears to be weakening.

Source: TradingView

Additionally, the Moving Average Convergence Divergence (MACD) remained in negative territory.

The MACD line was slightly below the signal line, with the histogram showing smaller red bars, suggesting a potential bullish crossover.

This could indicate the possibility of further price recovery if positive momentum continues.

Market sentiment and broader implications

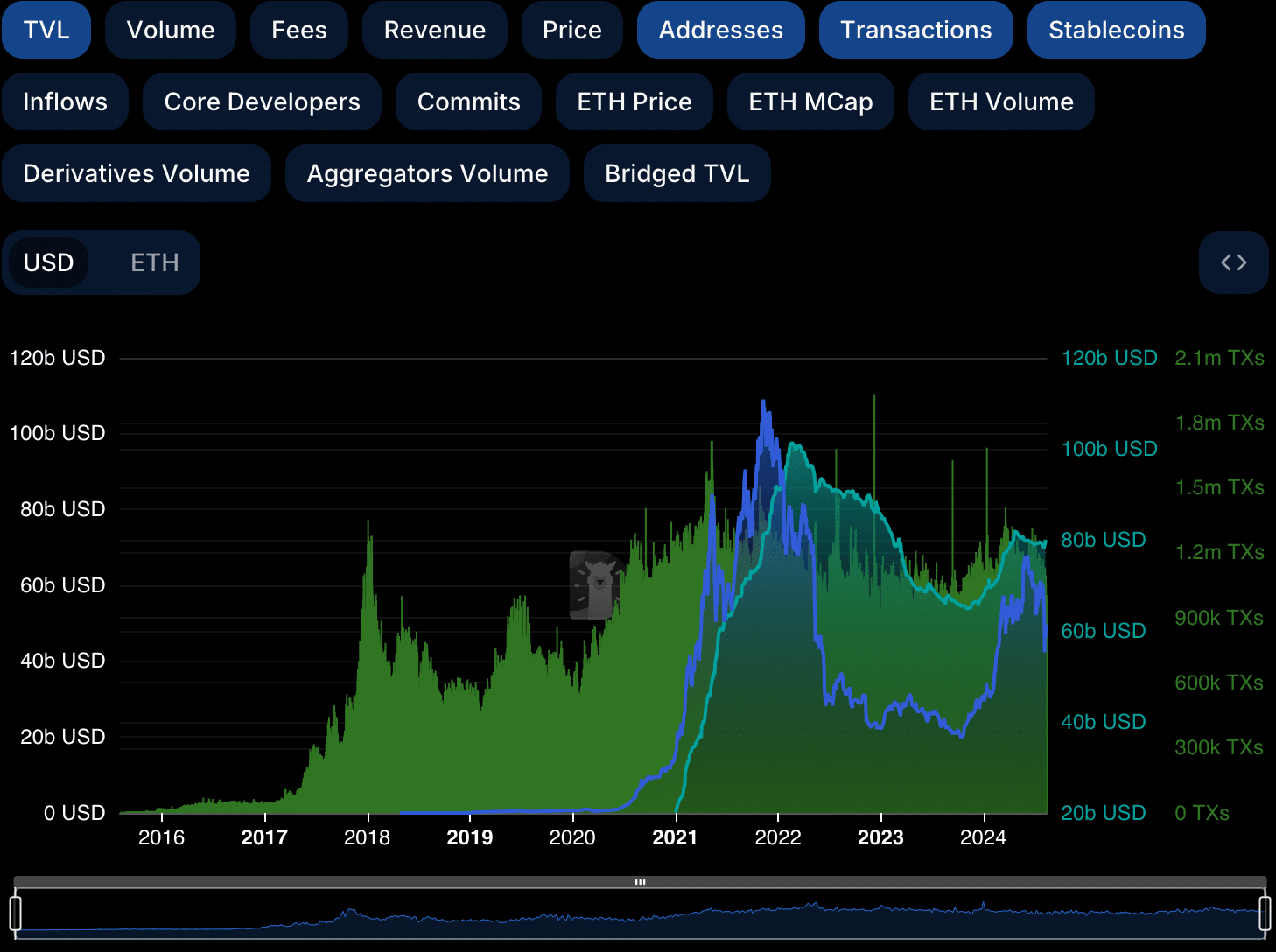

According to DefiLlama, the Total Value Locked (TVL) in Ethereum’s ecosystem was $47.824 billion, with stablecoin market capitalization at $79.913 billion.

Over the past 24 hours, fees generated amounted to $1.19 million, with $380,540 in revenue.

Source: DefiLlama

Active addresses within this period reached 299,749, with 64,793 new addresses and 1 million transactions, indicating ongoing robust network activity.

Read Ethereum’s [ETH] Price Prediction 2024-25

The recent assessment by AMBCrypto pointed to a neutral sentiment in the Ethereum market, with the Fear and Greed Index logging a score of 38, up from extreme fear levels a week ago.

This shift in sentiment suggested growing investor confidence, which may support ETH in testing and potentially breaking the $2,800 resistance level.