Opinions expressed by Entrepreneur contributors are their own.

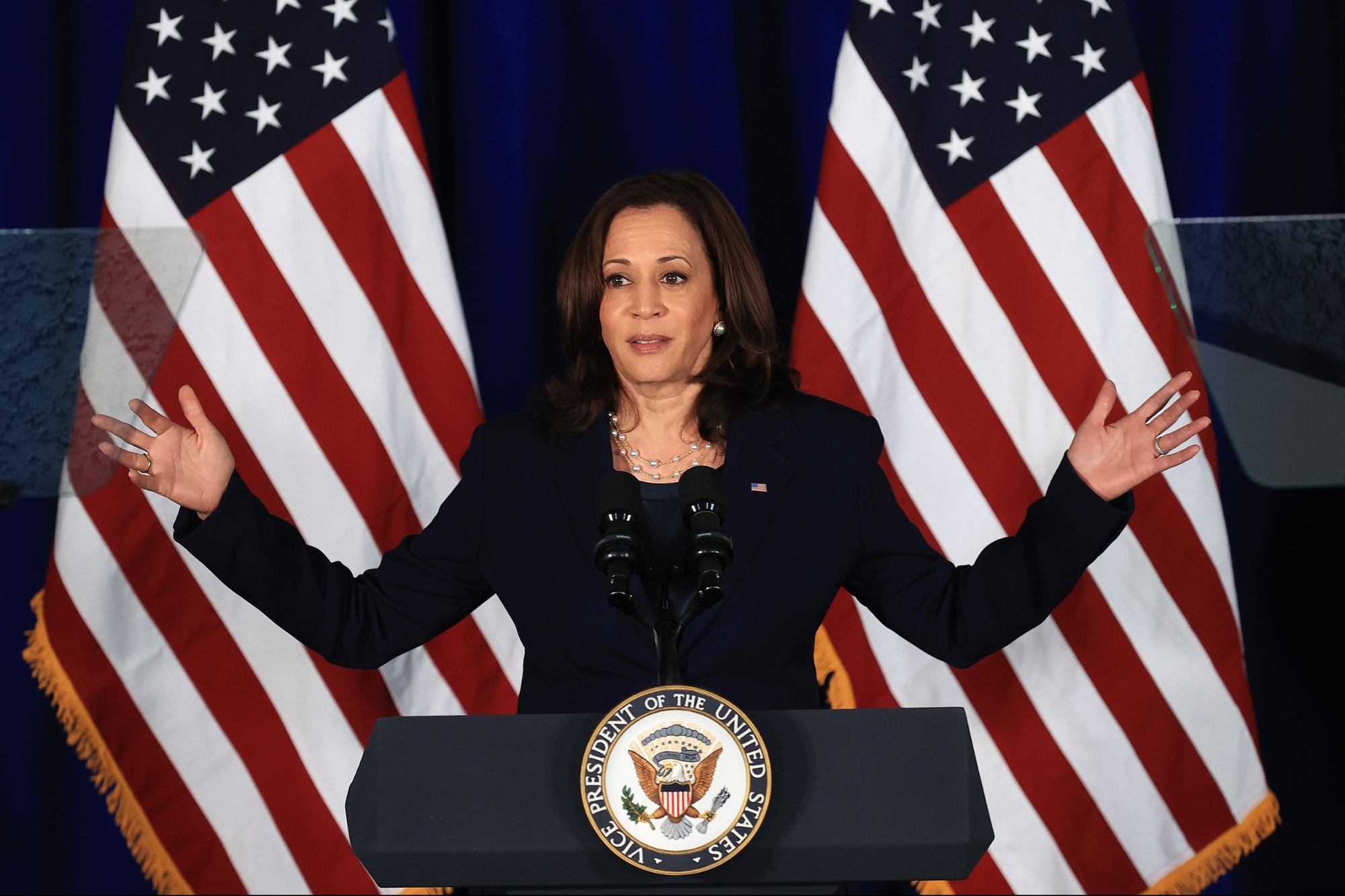

Kamala Harris’ campaign strategy has been to paint broad strokes about how she would approach the job of President while being mostly vague on policy specifics. To that end — and as of this writing — she hasn’t said much about taxes other than raising the corporate tax rate and not taxing tips.

However, most experts agree that she’ll likely continue and champion most, if not all, of President Biden’s already stated tax policies, with an emphasis on increasing taxes on wealthier individuals and corporations to fund her priorities and pay down the deficit.

As a certified public accountant, I see at least 10 significant ways a Harris administration would impact your personal and business tax bill. Let’s unpack.

Related: 10 Significant Ways A Second Trump Administration Could Impact Your Taxes

Tips

Like her opponent, Harris has championed a no-tax-on-tips policy aimed at service industry workers. Not only would this change help businesses attract more workers, but it could also allow employers to rely more on their customers’ tip compensation than having to pay more wages. In addition to the loss of tax revenues from this plan, opponents of the measure say that it is discriminatory and could lead to corporate abuse unless there are very strict definitions as to what qualifies as “tip” income.

Corporate tax increase

The current tax rate paid by “C” Corporations is 21%. Harris has recently championed increasing this rate to 28%. Such a change would, of course, increase the taxes paid by companies in this group. According to the Tax Foundation, a 28% corporate tax rate would make America’s companies face one of the highest tax environments in the world.

Allowing the 2017 TCJA to expire

The 2017 Tax Cuts and Jobs Act (TCJA) contained many tax benefits for both large and small businesses, including reduced corporate, individual and estate tax rates, incentives for spending on research and development and investing in capital equipment and a significant break for pass-through small businesses (the Qualified Income Business Tax Deduction). However, many are trying to make some or all of these provisions permanent (or extend them); Harris has been vague on which provisions — if any — she would support going forward.

Unrealized gains

President Biden and key Democrats such as Bernie Sanders and Elizabeth Warren have long championed a tax of as much as 25% on unrealized gains for those with assets over $100 million, and Harris leans towards this as well. Although there have been prior arguments about the constitutionality of such a measure, a recent Supreme Court decision opened the door to allowing such a tax. Taxing unrealized gains will involve regular and complicated valuations of property such as artwork, real estate and other personal assets.

Increased enforcement

Under the Biden Administration, $80 billion was allocated to the Internal Revenue Service to update its systems and improve enforcement. Just last year, IRS Commissioner Daniel Werfel publicly announced the agency’s intention to aggressively pursue mostly wealthy taxpayers (those earning more than $400,000 annually) and those who owed back taxes. Harris would likely offer no resistance to these actions and may encourage and even propose more funding.

Increase in childcare tax credit

Like President Biden, Harris has supported increasing the childcare tax credit. Currently, it provides up to $2,000 per child under the age of 17. Her proposal is to increase this credit to $6,000. President Trump is also proposing an increase to this credit to as much as $5,000 per child. In addition to providing benefits for parents of young children, the credit can help pay for additional childcare services that will help employees miss less work.

Related: What Did Biden and Trump Say About Business and the Economy at the Presidential Debate? Here’s Everything You Need to Know.

Increased cap gains tax

President Biden has proposed increasing the tax charged for capital transactions (for example, stock, property and equipment sales) from the current rate of 20% to as much as 44.6%. Although such an increase would certainly raise more tax revenues, some — like myself — are concerned about the impact on business owners who buy and sell capital assets as well as those who make investments or plan on exiting their businesses in the future.

Increased Medicare tax

Harris has voiced no opposition to her party’s support for increasing the Medicare tax from the current 3.8% to 5% for those earning more than $400,000 per year.

New crypto taxes

The crypto industry has grown substantially over the past few years and has not escaped the federal government’s attention. In past budget proposals, President Biden has floated a new “crypto mining tax” and included crypto transactions as part of “wash sales” so that any loss on the sale of crypto assets can only be realized if the same asset is not re-purchased within 30 days. So far, Harris has been silent on these proposals.

Increase in China tariffs

Both former President Trump and President Biden have encouraged higher tariffs on imported Chinese goods. Earlier this year, President Biden announced significant tariff increases on certain Chinese materials, including aluminum, steel, semiconductors and electric vehicles. Harris has not stated her position on this, although she will likely continue to support these tariffs.

A Harris presidency — assuming Congressional support — would almost certainly mean an increase in taxes for many business owners and certainly those who earn more than $400,000 per year. Many feel that the increases can be afforded, and the funds raised will help to pay for her programs and hopefully reduce budget deficits.